Since the number of Decentralized finance wallets has crossed 30 Million on Ethereum, the staking concept has been widespread even further. Wealth creation has been one of the most focal points for many crypto service providers and protocols. Skating is one lucrative way for DeFi users to monetize their crypto assets, above and beyond crypto trading. Also, POW (proof-of-work) is not a very sustainable model for blockchain. As a result, most blockchains are shifting to or adopting POS (proof-of-stake) consensus. With that Defi staking seems to have a sustainable and lucrative future. In this context, let’s understand Defi staking and Defi staking platform.

- What is DeFi Staking platform?

- What are the different types of DeFi Staking?

- Why start-ups and enterprises are investing in DeFi Staking platform development?

- What key features are required in a DeFi Staking platform?

- What are the steps to participate in the DeFi Staking?

- What are the benefits of the DeFi staking platform?

- Conclusion

What is DeFi Staking platform?

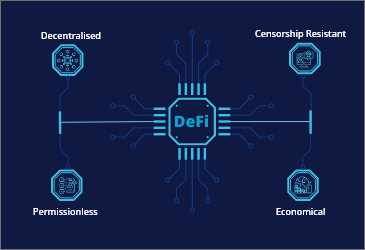

Many users of centralized staking platforms have taken a keen interest in knowing what a DeFi staking platform is and how the whole module functions? DeFi staking is an additional way to earn profits from your cryptocurrency assets by leveraging on the benefits given by the decentralized finance platform. The theory of staking in a centralized and decentralized environment can be different from each other. Before DeFi came into existence staking was considered as a process of authorizing transactions and adding a new block to the blockchain and getting compensated for doing it so. Whereas DeFi staking in its most narrow DeFinition can be referred to as a practice of locking crypto assets in a smart contract in exchange for becoming a validator in a DeFi protocol or a layer 1 Blockchain and earning the profits of performing the required duties. In a broader sense, DeFi staking is often used for all DeFi activities that require a temporary commitment of a user for the crypto assets in a DeFi staking platform.

What are the Different Types of DeFi Staking?

We will take a closer look at staking and the other two DeFi staking forms – Yield farming and Liquidity Mining.

Staking

The purest form of staking involves locking a set amount of crypto assets to become a validator in a Proof – of – stake (Pos)blockchain network. Proof of work (Pow)relies on algorithms where transaction validation requires computation work whereas Proof of stake (Pos) relies on validators for validating the payment. In other words, the validators have to perform their duties diligently otherwise they are at the risk of losing a portion of even the entire of their stake. Also, validators are eligible to receive staking rewards for creating and validating blocks. The most high-profile PoS blockchain is currently Ethereum, other notable examples include Polkadot and The Graph.

Yield Farming

While lending and borrowing platforms provided the first strong use case of decentralized finance, the rise of yield farming showed the true power of DeFi’s. The term refers to the practice of moving multiple crypto assets over DeFi staking platforms to churn out maximum profit. People make their assets available on a lending protocol or a liquidity pool and they earn passive income in the form of interest and also a portion of the revenue generated by their DeFi staking platform of choice.

Liquidity Mining

Liquidity mining is a subcategory of yield farming that involves depositing crypto assets and tokens to liquidity pools. These pools are crucial for enabling trading without any intermediaries involved in a type of Decentralized Exchange(DEX) known as Automated Market Maker. A typical liquidity pool consists of two assets that make up a particular trading pair. So the whole system relies on the liquidity providers who make the assets available at the liquidity pool.

Why start-ups and enterprises are investing in DeFi Staking platform development?

Many Startups and enterprises take a keen interest in DeFi Staking Platform development as it is a great way to attract users to their platforms. The more encouraging rewards a startup is offering in its DeFi Staking Platform the more users will take interest in contributing their assets in the DeFi staking platforms liquidity pool. The reliability of a DeFi staking platform in the eye of users depends on how much Liquidity it is providing. Also by providing staking opportunities in the platform the startups & enterprises will have a higher number of transactions that will yield more transaction fees. So the startups and enterprises have started to incorporate yield farming and liquidity mechanisms in their DeFi staking platforms as it brings more users to stake in the liquidity pool.

What key features are required in a DeFi Staking platform?

The choice of features of your DeFi staking model process depends largely on which staking model you have chosen and what kind of services you want to provide to your users. The list that we will be sharing below will help you when you are choosing features for your DeFi staking Platform Development.

User–Friendly Interface

DeFi protocols aren’t always easy to understand, moreover, the more the UI is complicated the more users get driven away. Thus it becomes very critical to make the interface user-friendly and promising. For users, dealing with managing private keys, complex wallets, and the reward withdrawing system must be effortless. From the sign-up process to choosing assets for staking at liquidity pools must not cause any complications.

List of supported assets and their protection

The fact that DeFi platforms are not regulated, so no one will provide funds to users once it’s lost so. Therefore security becomes a decisive factor when someone is choosing a DeFi Platform for staking. With the growing number of DeFi Platforms, consumers are searching for an efficient one so to avoid any disrupts, examining and auditing a smart contract will be the finest thing to do.

Rewards calculator

The main goal of liquidity investors and providers is to yield profit so they will consider knowing that how profitable a DeFi staking platform is. Some platforms have fixed prices and some calculate rewards based on different DeFi Market conditions. Usually, the following factors are taken into consideration while calculating a reward :

1. The share of coins shared by the staker and the share of coins in the network

2. The inflation rate of the coins

3. The time duration of staking

Taking all the following factors into consideration you can embed a reward calculator in the user interface so the stakers can immediately calculate how much amount they are designated to receive.

Payouts

Payouts are another important issue that interests the users of the DeFi staking platforms. DeFining an interesting payout schedule and withdrawal procedure can help the users have a clear picture of when and how will they receive their share of rewards. Also adding transaction history will enable a user to track its own past activity.

What are the steps to participate in the DeFi Staking?

DeFi staking is a process that requires users to lock a certain amount of native tokens. This enables them to contribute to a PoS network. The PoS mechanism relies only upon validators having to stake in the chain. Thus, users become validators soon after the locking process.

While staking, the sole responsibility is of the validators to carry out the job efficiently and ensure no loss of the stake occurs during the procedure. Furthermore, validators also have an opportunity to earn staking incentives, motivating them to validate and create blocks.

The DeFi staking journey follows four easy steps, including:

1. Choose a DeFi Staking Platform

2. Depositing cryptocurrency funds to be staked

3. Choosing a validator

4. Earning staking rewards

Comprehensive development services to help you lead the future-ready DeFi projects.

Launch your DeFi project with LeewayHertz

What are the benefits of the DeFi Staking platform?

The structure of a Decentralized Exchange (DEX) blockchain network is designed in such a way that each and every block is verified by the Proof- of – stake (POS) consensus. Individuals or users who are locking their crypto assets on the DeFi platform will be obliged to participate in overseeing the transaction and will also be rewarded for doing it so. Staking tokens means holding or locking tokens in the smart contract. When the stakes are locked up the user will be given power for approval to vote for executing any transactions. There are some additional benefits of staking up tokens in a blockchain network which are mentioned below :

- Staking tokens as a user will help you in earning passive income from your digital assets.

- The potential interest rates will be much higher if you are staking with DeFi tokens.

- DeFi tokens are protected by a smart contract which is highly secure.

Conclusion

Clearly staking in DeFi platforms is a new way to earn passive income and people are getting interested more in it day by day. Staking encourages long-term participation in a blockchain network as validating nodes will have to put a certain amount of assets to verify the blocks. Bitcoin’s Proof of Work (PoW) powers failed to grab enough attention from the cross-government bodies and financial regulators as per the expectation. With the ominous rise of the Defi skating platform, Proof of stake(PoS) is all set to overtake Pow blockchains in the long run. Compared to Pow the Pos blockchain network is more economical, secure and environment friendly as well.

As industry trends indicate the boom of POS blockchains, Defi staking holds a strong future. Development of Defi staking platforms or integration of Defi staking in existing blockchain-based platforms has the potential to pull the global cryptocurrency users. With years of expertise in Defi development, our team can help startups and enterprises launch their Defi staking platforms on different PoS blockchains. We provide insights into the technical aspects of DeFi technology trends, enabling you to make informed decisions for incorporating them into your business strategy.

If you want to build your DeFi skating platform, we are happy to collaborate with you. Please get in touch to discuss your project requirements.

Start a conversation by filling the form

All information will be kept confidential.

Insights

DeFi asset tokenization: Unlocking new possibilities

DeFi asset tokenization is the next step in the evolution of securitization, made possible by blockchain technology.

Wrapped tokens: An innovative approach to interoperability

Learn how wrapped tokens play a critical role in enabling cross-chain interoperability and in providing new financial services within the blockchain ecosystem.

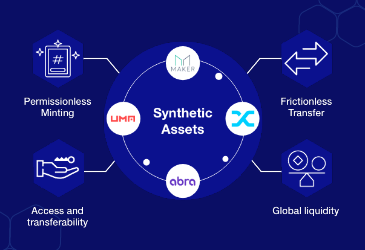

What are synthetic assets in decentralized finance

Crypto synthetic assets are gaining popularity in the crypto world as they allow investors to benefit from token fluctuations without actually owning them.