DeFi asset tokenization: Unlocking new possibilities

Listen to the article

DeFi has the potential to revolutionize the financial industry by making financial services more accessible, transparent, and secure. It has the potential to democratize access to financial services, particularly in regions where traditional financial institutions are scarce or unreliable. On the other hand, the global tokenization market value is expected to increase from $1.9 billion in 2020 to $ 4.85 billion by 2025 at a CAGR of 19.5%. This suggests that the global tokenization market is rapidly growing and shows no signs of stopping.

But what does tokenization in the crypto world mean? Tokenization is the process of representing a real-world asset using a digital token on the blockchain. In the context of DeFi, tokenization can refer to the creation of digital tokens that represent assets like commodities, real estate, or even art. These tokens can then be traded on decentralized exchanges, allowing for more efficient and transparent buying and selling of the underlying assets. Tokenization can also enable the creation of new types of financial instruments, such as stablecoins (digital tokens pegged to the value of real-world assets, like the US dollar), to provide a stable store of value. This facilitates the use of cryptocurrencies in more mainstream financial applications, such as the payment of bills and making purchases.

In this article, we will discuss the concepts of DeFi and asset tokenization along with the nitty-gritty involved in Defi asset tokenization.

- What is DeFi?

- What is asset tokenization?

- Types of tokenized assets

- Benefits of asset tokenization

- Real-world use cases of asset tokenization

- How does DeFi asset tokenization work?

- Key steps to DeFi asset tokenization

What is DeFi?

Decentralized finance, also known as DeFi, can seem a bit confusing to the uninformed. Decentralized finance is an emerging financial system that uses blockchain technology. It can be described as those traditional financial services or products that are built on top of a decentralized and uncontrolled blockchain infrastructure. Decentralized finance works with cryptocurrency but does not include financial institutions or governments. It is a crowdsourcing initiative that looks a lot like a crowdsourcing project. This system uses automated programs to perform the traditional banking functions of traditional finance or TradeFi. DeFi can replace TradeFi, where control is distributed among the system’s stakeholders and gives users more control over their assets. Additional benefits include the ability to access DeFi from anywhere with just access to an internet connection. DeFi is not complicated; you don’t need to be a professional crypto trader as long as you are familiar with the fundamentals.

The DeFi initiative focuses on peer-to-peer relationships, which can offer a wide range of financial services. This includes everything from day-to-day banking, loans, and mortgages, to more complex contractual relationships and asset trade. The DeFI finance market, launched in 2018, has been one of the most profitable submarkets in the cryptocurrency industry.

Characteristics and benefits of decentralized finance

To increase financial security, transparency, liquidity, and growth opportunities, decentralized finance uses key principles from the Ethereum blockchain, which supports an integrated, standardized economic system.

- Programmability – Highly programmable smart contracts automate execution and allow the creation of new financial instruments.

- Immutability – Tamper-proof data coordination across decentralized blockchain architecture increases security and auditability.

- Interoperability – Ethereum has a composable software platform that allows applications and protocols to be built to work together. DeFI allows developers anproduct teams to customize interfaces and build on top of existing protocols. DeFi protocols are often referred to as “money legos.”

- Transparency – Every transaction on the public Ethereum blockchain is broadcast to and validated by other users. Transactions around transaction data allow rich data analysis and ensure that anyone can access all network activity. Open-source code is used to build Ethereum and DeFi.

- Permissionless – DeFi is open and permissionless. Anyone with a cryptocurrency wallet and an internet connection can access DeFi apps built on Ethereum.

- Self-custody – DeFi market participants use web3 wallets such as MetaMask for access to permissionless financial apps and protocols. They always have custody of their assets and control over their personal data.

What is asset tokenization?

Blockchain stands to revolutionize the financial world by allowing assets to be turned into tokens and traded on crypto trading platforms. Besides providing exclusive ownership, it encourages the democratization and inclusion of historically illiquid assets to establish fairer markets. Everything can be tokenized via a distributed ledger, regardless of whether it is paintings, digital media platforms, real-estate properties, company shares or collectibles. Now, coming to asset tokenization, it is when an issuer creates digital and physical tokens against some asset. Blockchain ensures that your ownership of an asset is immutable after you have purchased its tokens.

Imagine you own a property in New York worth $500,000. Asset tokenization could make this property ownership fractionalized, making it more affordable by converting it into 500,000 tokens. Let’s suppose you need $50,000 in loans. Selling the property would not make financial sense because you still need money. Instead, you issue tokens on a publicly distributed ledger such as Hedera Hashgraph, allowing anyone to buy or sell on various exchanges. A token allows someone to buy ownership of the asset. To become a 100% owner of the property, you must purchase 500,000 tokens. As distributed ledger technology is immutable, that no one can take away the ownership of an investor who bought tokens or shares in a property.

Types of tokenized assets

Fungible asset tokenization

Two main characteristics make up a fungible asset:

- Interchangeable – Each unit of the tokenized assets has the same market price and validity. For instance, all units of 1 $BTC have exactly the same market value and can be interchanged. You don’t need to know from whom you bought a $BTC, as all BTC units are the same functionality and are part of the same network. Your $BTC’s 1% can be exchanged for any other’s 1%.

- Divisible – A fungible cryptocurrency may be divided into as many decimal points as were set up during its issuance. Each unit will have the exact same value and validity.

Non-fungible asset tokenization

A non-fungible token is:

- Non-interchangeable – NFTs cannot replace tokens of the same type because each token has a unique value.

- Non-divisible – Although NFTs are rarely divisible, F-NFTs offer fractional ownership of NFTs such as commercial real estate or expensive fine art.

- Unique – Each token is unique and different from other tokens of the same type.

Benefits of asset tokenization

There is a huge difference between traditional digitalization and asset tokenization on the blockchain, primarily due to how they are used. Retail investors and industrial sectors can reap immense benefits from asset tokenization on the blockchain, which gives assets a unique identity. These are just a few of the reasons asset tokenization is so important.

Increased liquidity

The first and most important benefit of asset tokenization on the blockchain is better liquidity. It provides a platform for users to create smart contracts to execute transactions and ensure transparency. Token holders can sell their tokens on the secondary market, so they don’t need to worry about early redemption or the associated costs. This allows anyone with a substantial net worth to trade and invest in private company securities. Agents and individuals can contribute to the creation of a global market for private securities trading and investing through tokenization.

Higher efficiency and automation

Smart contracts are extremely helpful in automating the tokenization process. They eliminate the need for intermediaries and reduce the costs involved. This also eliminates the need for extra effort in managing and regulating the entire process, which improves overall efficiency.

Transparency

The tokenization of assets provides greater transparency for users. They can embed their rights and obligations and define the token attributes to reflect the ownership record. It also allows the user to see who they are dealing with, what terms and conditions they have to accept, and where their purchase came from. This openness improves transparency in transactions.

Enhanced accessibility

Asset tokenization also offers greater accessibility for the user. A user can also use asset tokenization to convert a portion of an asset into as many tokens as possible. Asset tokenization allows potential investors to own the minimum share in different investments. This allows any retail investor, financial

institution or business to enter the asset management field with enough flexibility in terms of investment amount and duration.

Real-world use cases of asset tokenization

Asset tokenization on the blockchain has many real-world benefits. It helps parties to develop custom solutions for their respective industries. Asset tokenization is becoming more important as blockchain technology gains momentum in many industries. This allows these industries to create smart solutions. Let’s take a look at how asset tokenization can be beneficial across different sectors. These are the most popular use cases for asset tokenization on blockchain-

Finance

One of the many applications of blockchain in the DeFi sector is tokenization. It’s changing the landscape in many ways, including margin lending, product structuring, investments, and payments. Finance organizations have the opportunity to convert all assets into digital crypto-currencies, which can be traded seamlessly. Merchants can now store credit card numbers electronically without having to keep them in POS machines or other systems. As a whole, this increases liquidity on the market and reduces data security breaches.

Tokenization of equity shares allows users to have multiple tokens for the same credit card. It doesn’t matter if you used any token online; if that website is hacked, it won’t be easy to reverse-engineer the code or find the credit card number. AlgoZ’s partnership with OmiseGo is a real-world example of this emerging trend in investment strategy.

Real estate

Real estate is another business area that reaps the benefits of developing tokenized assets. Real estate tokenization simplifies the investment process. It eliminates intermediaries making it simpler and more cost-effective for sellers and buyers to communicate with one other. You can also invest any amount, which makes it a more open marketplace. This concept also reduces fraud risk. As per a market study, 66M buildings will soon be tokenized on the Ethereum blockchain under a record deal. Many platforms offer exceptional services when it comes to real estate tokenization. Meridio, Slice, and Harbor are just a few of them.

Healthcare

To settle some of healthcare’s major problems, the sector is considering tokenization. Tokenization replaces sensitive patient data with unique and insensitive values. This reduces data breach cases. Tokenization also allows patients and medical organizations to access, create, and share sensitive information from intermediaries such as insurance companies. Tokenization of healthcare information and processes allows patients to verify their data’s accuracy while saving substantial amounts to third parties.

Clincoin is an excellent example of understanding tokenization’s potential in healthcare. The blockchain-based platform connects users, developers, and providers. It also rewards users who engage in healthy activities. These tokens can be used to purchase digital tools, products and services on a decentralized marketplace.

Sports

The sports industry is another industry that has seen significant positive changes since the advent of asset tokenization. Blockchain platforms allow investors and fans to trade the gains from asset tokenization, which decentralizes the entire marketplace. This allows players and sports clubs to meet their financial goals better and make more money. Numerous sports clubs and companies have begun to look into this idea, while others are already planning to adopt it. One example of this is the Manchester City- Superbloke partnership.

Enterprise

In its massive shift to the blockchain, enterprises also take advantage of the tokenization potential of real-world assets. Enterprises use this concept to expand their market reach, assess employee performance, allocate resources properly, create better incentive models and increase transparency in all internal processes. Enterprises also offer different tokens for different types of assignments to provide a customized experience. To show their importance, they award tokens with a specific amount. This is something that goes beyond the scope of labels such as ‘high-priority’ and ‘urgent,’ which product managers used earlier.

The art industry

Blockchain can make art accessible to everyone, not just art lovers but artists too. Artists can now tokenize and sell their work around the globe without intermediaries. The successful tokenization and sale of a multi-million-dollar artwork were among the most recent stories. Andy Warhol’s painting “14 Small Electric Chairs (1980)” was one that was sold approximately in £4.2 million. This beta auction was intended to test the Dutch auction process and also check the functionality of artwork tokenizations and blockchain technology.

Many more business verticals will be able to use the concept of managing tokenized assets.

How does DeFi asset tokenization work?

To tokenize assets, you first need to understand smart contracts’ role in turning real assets into digital assets. Smart contracts are used to control and execute digital tokens that are backed by underlying assets. The parties’ agreements are written in lines of code that already exist on the blockchain network. This makes smart contracts self-executing and enforceable. Tokens can be delivered directly to investors once the contract conditions have been met. Smart contracts offer transparency, accuracy, and efficiency for participants by making historical data and contractual teams publicly available.

Asset tokenization is a technical term that refers to the creation of an informatic code that highlights key elements of an asset and provides some methods for the user to interact with the digital representation. This informatic code was created in Solidity for the Ethereum blockchain.

The steps to asset tokenization can be broken down as follows:

Choose the asset representation model

The Ethereum community has developed token standards to represent different asset types. These standards make it easier to adopt distributed digital assets. They allow interoperability among different blockchain projects. A token standard is a set of functions that can represent an asset’s unique characteristics. Before deciding which token standard you should use, it is important to evaluate the asset’s fundamental properties. Keeping your privacy in mind is important when deciding how an asset should be tokenized. Blockchain introduces transparency by default, but not all sectors and use cases can accept it. This issue can be mitigated by technologies such as zero-knowledge proof, particularly for private blockchains.

Modify the asset

Before implementing the token model for asset representation, it is important to consider many aspects. It should be clear which data will be stored on-chain or off-chain. When developing the code and behavior of the token, it is important to consider any legal and regulatory restrictions on data privacy, data trust, and scaling requirements. Proper engineering is required to tokenize financial assets to manage liquidity, issuance and other aspects. As regulators might require issuers of digital assets to provide details about token behavior, a term sheet document should be included.

Examining the technical and security aspects of the informatics code

It is essential to conduct a smart contract audit using standardized methods. Expert third parties must evaluate and certify the informatic code before it goes online.

The deployment of the informatics code

The code can be deployed to the blockchain after completing a security assessment. It can either be public or private, depending on the use case. After the deployment of the informatic codes, users should be able to transfer and store these tokens.

Post-tokenization management

Token owners will receive future dividends or interest payments in tokenized assets in the form of cryptocurrency or equivalent fiat currency in their wallets. Additionally, digital token issuers are responsible for accounting, taxation, and financial reports.

Key steps to DeFi asset tokenization

To introduce DeFi asset tokenization, asset tokenization companies follow the undermentioned key steps:

- Step 1: Select an asset to tokenize. To tokenize an asset, you can choose from real estate, a regulated instrument of financial management, physical commodities like precious stones, artwork, collectibles, intellectual property, cryptocurrency or even medicine.

- Step 2: Determine the appropriate token type, which could be a utility token, security token, or NFT.

- Step 3: Analyze the global country and industry-specific legal requirements relevant to the asset. For example, SEC regulations regarding financial securities and HIPAA in healthcare assets.

- Step 4: Create a tokenomics model that defines tokenized asset demand and supply characteristics. It also describes the token value and the rights associated with assets.

- Step 5: Select the optimal blockchain platform for asset tokenization.

- Step 6: Develop smart contracts to program the behavior of the tokenized asset and automate the compliance check for legal regulations.

- Step 7: Develop a blockchain-based asset management application for token investors and token holders.

- Step 8: Integrate the tokenized asset solution to required systems, such as crypto wallet and accounting software, payment gateways, and KYC/AML verification service.

- Step 9: Perform the token issuance in the form of ITO or STO, IDO, and others. You can use your own blockchain platform or a third-party one to allow token distribution and primary purchase of tokenized assets by investors.

- Step 10: Perform token listing on user-definable token exchanges to allow tokenized asset trading on secondary markets.

Endnote

DeFi asset tokenization is the next big step in the evolution of securitization, made possible by blockchain technology. Distributed ledgers allow for unprecedented transparency, transactional efficiency, and risk control. It can also liquid previously inaccessible asset classes, thereby significantly increasing financial involvement and information efficiency in these markets. We can expect to see more innovative and value-creating tokenization apps in the future, particularly for previously unavailable assets or available only to a small number of investors.

If you want to digitize tangible and intangible assets and convert them into tokens, contact LeewayHertz’s team of experts for hassle-free asset-backed token development!

Listen to the article

Start a conversation by filling the form

All information will be kept confidential.

Insights

Wrapped tokens: An innovative approach to interoperability

Learn how wrapped tokens play a critical role in enabling cross-chain interoperability and in providing new financial services within the blockchain ecosystem.

What are synthetic assets in decentralized finance

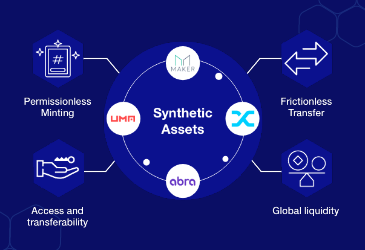

Crypto synthetic assets are gaining popularity in the crypto world as they allow investors to benefit from token fluctuations without actually owning them.

All about Blockchain Explorer

Blockchain explorer is an online tool that allows one to search for real-time information about a blockchain, such as data related to blocks, transactions, and addresses.