DeFi asset tokenization: Unlocking new possibilities

DeFi asset tokenization is the next step in the evolution of securitization, made possible by blockchain technology.

DeFi asset tokenization is the next step in the evolution of securitization, made possible by blockchain technology.

Learn how wrapped tokens play a critical role in enabling cross-chain interoperability and in providing new financial services within the blockchain ecosystem.

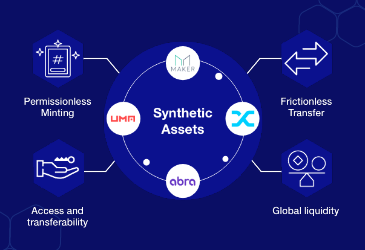

Crypto synthetic assets are gaining popularity in the crypto world as they allow investors to benefit from token fluctuations without actually owning them.

Blockchain explorer is an online tool that allows one to search for real-time information about a blockchain, such as data related to blocks, transactions, and addresses.

Proof of Reserve is an auditing practice addressing the transparency issues of assets kept on exchanges. It is a much-needed inspecting technique to ensure that real assets back crypto in a decentralized space.

DeFi 2.0 is an improved version of the expansive DeFi ecosystem that resolves to fix its flaws and build on its strengths. It offers consumers exciting new opportunities to advance on their path to financial freedom.