AI in loan underwriting: Use cases, architecture, technologies, solution and implementation

Artificial Intelligence (AI) is emerging as a transformative solution to these challenges. By automating routine tasks such as data collection and risk assessment, AI can significantly cut down the time and resources required for manual processes. AI systems can swiftly and accurately analyze large datasets, reducing human error and speeding up decision-making. In fact, according to McKinsey, automation in the insurance industry can reduce claims processing costs by up to 30%, showcasing its potential to enhance efficiency across financial operations.

Furthermore, AI’s role extends beyond just improving efficiency. It provides a more personalized customer experience by leveraging data analytics to tailor loan offers and decisions to individual borrower profiles. This personalized approach not only improves customer satisfaction but also enhances the precision of risk assessments, ultimately leading to better outcomes for both lenders and borrowers.

This article delves into the transformative role of AI in loan underwriting, exploring how machine learning algorithms streamline data processing, fortify risk assessments, and ultimately expedite loan approval processes. By shedding light on the challenges faced by traditional underwriting methods, the article will unravel the innovative solutions AI brings to the forefront, ushering in a new era of efficiency, precision, and agility in loan sanctioning.

- What is loan underwriting?

- A brief overview of AI in loan underwriting

- Traditional loan underwriting vs. AI-based loan underwriting

- How does AI in loan underwriting work?

- Use cases of AI in loan underwriting

- Streamlining loan underwriting processes with generative AI

- How does LeewayHertz’s generative AI platform optimize loan underwriting processes?

- LeewayHertz’s AI development services for loan underwriting

- The operational advantages of AI in loan underwriting

- AI technologies transforming loan underwriting

- Best practices for implementing AI in loan underwriting

- The future of AI in loan underwriting

What is loan underwriting?

Loan underwriting is the process by which a financial institution evaluates the creditworthiness of a borrower and assesses the risk associated with lending money to them. During underwriting, the lender reviews various aspects of the borrower’s financial situation, including credit history, income, employment stability, and debt-to-income ratio. The objective is to assess the probability that the borrower can repay the loan, considering their financial profile. Lenders use underwriting to make informed decisions on whether to approve, modify, or deny a loan, as well as to establish the terms and conditions, such as interest rates and loan amounts. The underwriting process is crucial for managing risk and ensuring responsible lending practices.

A brief overview of AI in loan underwriting

Recognizing the transformative impact of artificial intelligence on the traditional lending landscape is essential in understanding AI in loan underwriting. AI is transforming the underwriting process by harnessing advanced machine learning algorithms and data analytics, facilitating more informed and efficient credit decisions. In contrast to traditional methods, AI-enabled underwriting rapidly analyzes vast datasets, incorporating alternative sources like social media activity, transaction histories, and behavioral patterns. This capability enables a more thorough and nuanced evaluation of a borrower’s creditworthiness, proving especially advantageous for individuals with limited credit histories. Furthermore, AI-driven models exhibit adaptability to changing economic conditions, enhance accuracy, and minimize human bias in decision-making. The integration of AI in loan underwriting not only streamlines processes but also promotes greater financial inclusion by providing a more holistic assessment of borrowers.

Traditional loan underwriting vs. AI-based loan underwriting

| Aspect |

Traditional loan underwriting |

AI-based loan underwriting |

|---|---|---|

| Processing time | Slow, manual process | Fast, automated process |

| Efficiency | Labor-intensive and prone to delays | Highly efficient and streamlined |

| Accuracy | Varies, dependent on human judgment | Consistent and data-driven |

| Consistency | Subject to human error and bias | Uniform decisions based on algorithms |

| Data utilization |

Limited to standard financial data |

Uses a wide range of data, including non-traditional sources |

| Scalability | Difficult to scale | Easily scalable with more data and resources |

| Cost implications | Higher operational costs due to labor | Lower operational costs, initial investment in technology |

| Risk assessment | Based on fixed criteria and manual checks | Dynamic and continuous risk evaluation using real-time data |

| Decision speed | Days to weeks | Minutes to hours |

| Customer experience | Slower response times | Faster approvals and better user experience |

| Compliance | Manual compliance checks | Automated compliance with real-time updates |

| Adaptability |

Slow to adapt to new trends |

Quick to incorporate new data and trends |

Optimize Your Operations With AI Agents

Optimize your workflows with ZBrain AI agents that automate tasks and empower smarter, data-driven decisions.

How does AI in loan underwriting work?

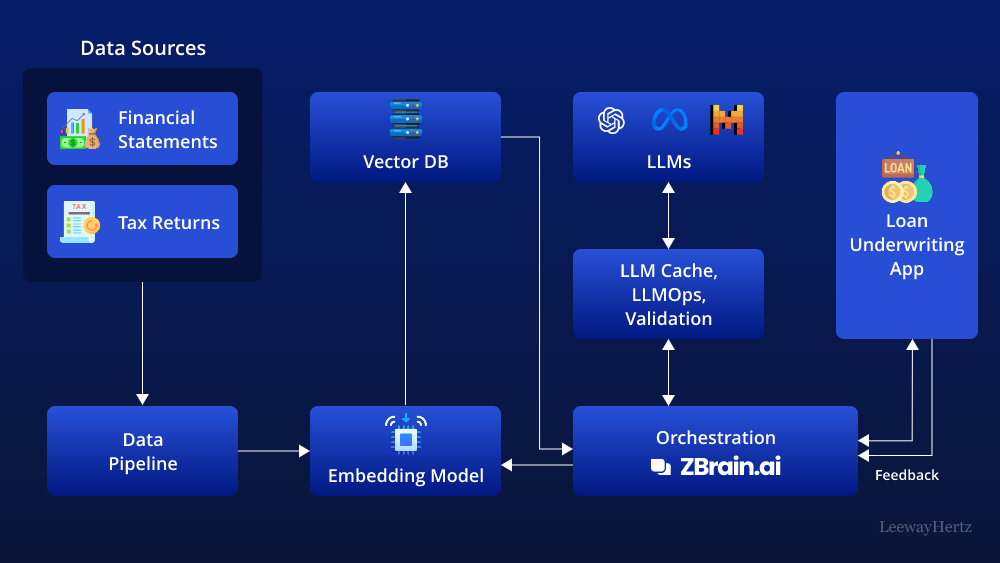

Integrating AI into loan underwriting utilizes various components to automate data analysis, expedite processing, extract actionable insights, and enable informed lending decisions. This surpasses conventional methods by integrating robust Large Language Models (LLMs) with the financial institution’s unique knowledge base. This approach enhances the comprehensiveness of analysis, facilitating prompt lending decisions. The architecture integrates multiple components to streamline and optimize the loan underwriting process. Here’s a detailed breakdown of how it operates:

1. Data sources: The initial step involves collecting data pertinent to the loan underwriting process from diverse sources. This data can include:

- Credit bureaus: Credit reports from major credit bureaus such as Equifax, Experian, and TransUnion to assess the borrower’s credit history, payment behavior, and overall creditworthiness.

- Financial statements: Financial statements provided by the borrower, including income statements, balance sheets, and cash flow statements, to evaluate their financial health and ability to repay the loan.

- Tax returns: Tax returns for the past few years to verify the borrower’s income and assess their tax liabilities, deductions, and financial stability.

- Employment verification: The borrower’s employment status and income by contacting their employer directly or requesting employment verification documents.

- Bank statements: Bank statements to understand the borrower’s cash flow, spending patterns, and financial habits, which can provide insights into their ability to manage debt and repay the loan.

- Asset documentation: Documentation related to the borrower’s assets, such as real estate holdings, investment accounts, and other valuable assets, to assess their overall financial position and collateral available for the loan.

- Credit references: Credit references from other lenders or creditors to gather additional information about the borrower’s creditworthiness and repayment history.

2. Data pipeline: The data gathered from the previous sources is subsequently channeled through data pipelines. These pipelines handle tasks such as data ingestion, cleaning, processing (including data transformations like filtering, masking, and aggregations), and structuring, thereby preparing it for subsequent analysis.

3. Embedding model: The processed data is segmented into chunks and fed into an embedding model. This model converts textual data into numerical representations called vectors, enabling AI models to comprehend it effectively. Well-known models for this purpose are developed by OpenAI, Google, and Cohere.

4. Vector database: The resulting vectors are stored in a vector database, facilitating streamlined querying and retrieval processes. This database efficiently manages the storage, comparison, and retrieval of potentially billions of embeddings (i.e., vectors). Prominent examples of such vector databases include Pinecone, Weaviate, and PGvector.

5. APIs and plugins: APIs and plugins such as Serp, Zapier, and Wolfram serve a critical function by linking various components together and facilitating additional functionalities, such as accessing supplementary data or executing specific tasks seamlessly.

6. Orchestration layer: The orchestrating layer plays a pivotal role in managing the workflow. An example of this layer is ZBrain, which streamlines tasks like prompt chaining, handling interactions with external APIs to determine when API calls are necessary, fetching contextual data from vector databases, and preserving memory across multiple LLM calls. This layer generates a prompt or series of prompts for submission to a language model for processing. Overall, its responsibility lies in orchestrating data flow and tasks, ensuring smooth coordination among all other components in this architecture.

7. Query execution: The data retrieval and generation process initiates when the user submits a query to the loan underwriting application. This query can be related to any aspect relevant to the borrower, encompassing factors like their financial history, creditworthiness, employment status, and loan requirements.

8. LLM processing: Upon receiving the query, the application forwards it to the orchestration layer. This layer then retrieves pertinent data from the vector database and LLM cache, sending it to the suitable LLM for processing, with the selection of the LLM dependent upon the query’s nature.

9. Output: The LLM generates an output based on the query and the data it receives. This output can take various forms relevant to loan underwriting processes, such as assessments of the borrower’s creditworthiness, identification of potential risks, generation of draft loan agreements, or summarizing the borrower’s financial profile.

10. Loan underwriting app: The verified output is then presented to the user via the loan underwriting app. This core application consolidates all data, analysis, and insights, presenting the findings in a user-friendly format and enabling decision-makers to review and act upon the information provided.

11. Feedback loop: User feedback on the LLM’s output is a crucial component of this architecture. This feedback is utilized to continuously enhance the accuracy and relevance of the LLM’s results, ensuring better performance over time.

12. Agent: AI agents play a vital role in this process by solving complex problems, interacting with the external environment, and enhancing learning through post-deployment experiences. They accomplish this by employing advanced reasoning and planning, strategically utilizing tools, and memory, recursion, and self-reflection.

13. LLM cache: To expedite the AI system’s response time, frequently accessed information is cached using tools like Redis, SQLite, or GPTCache.

14. Logging/LLMOps: During this process, LLMOps tools such as Weights & Biases, MLflow, Helicone, and Prompt Layer aid in logging actions and monitoring performance, ensuring optimal functionality of the LLMs and facilitating continuous improvement through feedback loops.

15. Validation: A validation layer is utilized to authenticate the LLM’s output, accomplished through tools such as Guardrails, Rebuff, Guidance, and LMQL, ensuring the precision and dependability of the information shared.

16. LLM APIs and hosting: LLM APIs and hosting platforms are integral for executing loan underwriting tasks and hosting the application. Depending on project requirements, developers can choose from LLM APIs like OpenAI and Anthropic or explore open-source models. Similarly, they have various hosting platform options, including cloud providers such as AWS, GCP, Azure, and Coreweave, or opinionated clouds like Databricks, Mosaic, and Anyscale. The selection of LLM APIs and cloud hosting depends on the unique needs and preferences of the project.

This flow offers a comprehensive insight into how AI streamlines loan underwriting, utilizing diverse data sources and technological tools to produce precise and actionable insights. Ultimately, by automating various loan underwriting tasks, AI enhances efficiency, mitigates risks and improves the overall quality of lending decisions.

Use cases of AI in loan underwriting

AI plays a significant role in transforming various industries, and loan underwriting is no exception. Here are some key use cases of AI in loan underwriting:

Creditworthiness assessment

- Enhanced credit scoring: AI algorithms analyze a wide range of data points, including traditional credit scores, transaction histories, and social media activity, to provide a more comprehensive credit score.

- Predictive risk models: AI can predict the likelihood of default by assessing risk factors more accurately, allowing lenders to make more informed decisions.

Summarization and classification

- Document summarization: AI excels at summarizing lengthy documents, providing quick reviews, and extracting key information.

- Business document classification: AI classifies business documents for efficient processing and organization.

Filling information gaps

- Completing forms: AI helps complete underwriting forms and validates information, ensuring all required details are accurately captured.

- Data enrichment: AI enriches incomplete or missing data by cross-referencing with external data sources and databases, filling in gaps and providing a more complete picture of the borrower’s profile.

- Automated data validation: AI verifies the accuracy and consistency of data entered into forms by comparing it against historical records and data patterns, reducing errors and ensuring the reliability of the information.

- Real-time data integration: AI integrates real-time data from multiple sources to update and complete underwriting forms dynamically, ensuring that the information used for decision-making is current and comprehensive.

Elevating customer experience

- Personalized financial advice: AI creates detailed and data-rich customer profiles by analyzing transaction data, and offering tailored advice on savings, significant purchases, and financial literacy.

- Exclusive offers: AI uses customer data to notify specific customers about exclusive deals and offers tied to their credit reputation, enhancing the customer experience.

Streamlined loan processing

- Automated decision making: AI automates 95% of manual underwriting decisions, especially in SME lending, making the process faster and more efficient.

- Data aggregation: AI tools can rapidly collect and analyze vast datasets from various sources, including financial industry, market, and news data. This enables the generation of risk evaluation scores and other insights based on comprehensive data analysis, supporting more informed decision-making.

Data remediation in loan applications

- Improving data quality: AI prioritizes and remediates data quality issues, ensuring the accuracy, completeness, and reliability of personal, financial, and credit-related information.

- Efficiency gains: AI-integrated programs and machine learning models speed up data remediation efforts, reducing backlogs and improving precision.

Data extraction through OCR in loan underwriting

- Efficient data extraction: AI-powered OCR technology extracts data from physical documents, such as cheques and loan applications, converting them into computer-readable text.

- Enhanced decision making: Deep learning-powered OCR captures additional data points from financial documents, providing a more comprehensive view of the applicant’s financial history. This richer dataset enables more informed and accurate loan underwriting decisions, leading to faster approvals for qualified applicants and potentially lower risk for lenders.

Loan underwriting through behavioral analytics

- Transactional insights: AI uses behavioral analytics to classify transactions and generate simplified financial statements, providing real-time insights into revenue, expenses, and affordability ratios.

- Customer experience: Behavioral analytics improves customer experiences and enhances the lending process by providing richer and more practical data solutions.

Fraud detection and prevention

- Anomaly detection: AI systems detect unusual patterns and behaviors in loan applications that may indicate fraudulent activity.

- Real-time monitoring: Continuous monitoring and analysis of transactions help identify and prevent fraudulent activities promptly.

Automated document processing

- Optical Character Recognition (OCR): AI-powered OCR technology quickly extracts and processes information from documents such as pay stubs, tax returns, and bank statements.

- Data verification: AI verifies the accuracy and authenticity of the information provided in loan applications, reducing the time required for manual checks.

Personalized loan offers

- Tailored recommendations: AI analyzes customer data to offer personalized loan products that match individual financial situations and needs.

- Dynamic interest rates: AI can adjust interest rates based on real-time risk assessment, ensuring competitive and fair pricing for borrowers.

Loan portfolio management

- Portfolio analysis: AI provides insights into the performance of loan portfolios, identifying high-risk loans and recommending actions to mitigate potential losses.

- Predictive analytics: AI forecasts future trends and borrower behaviors, helping lenders manage their portfolios more effectively.

Customer service and support

- AI chatbots: AI-powered chatbots handle customer inquiries, provide loan application status updates, and offer support throughout the loan process.

- Virtual assistants: AI virtual assistants guide customers through the loan application process, ensuring a smoother and more efficient experience.

Compliance and regulatory reporting

- Automated compliance checks: AI ensures that all loan applications meet regulatory requirements by automatically checking for compliance issues.

- Regulatory reporting: AI simplifies the creation of regulatory reports by extracting and organizing the necessary data, ensuring accuracy and timeliness.

Loan servicing and collection

- Proactive customer engagement: AI identifies borrowers at risk of default and proactively engages them with tailored repayment plans and support.

- Automated collection processes: AI streamlines the collection process by automating communication with delinquent borrowers and suggesting optimal collection strategies.

Predictive loan demand analytics

- Forecasting loan demand: AI analyzes market trends and customer behavior to predict future loan demand, helping lenders allocate resources and plan strategies effectively.

- Customer segmentation: AI can identify different customer segments based on borrowing patterns and tailor marketing campaigns to target these segments.

Sentiment analysis

- Customer feedback analysis: AI analyzes customer feedback from surveys, reviews, and social media to gauge borrower satisfaction and identify areas for improvement.

- Market sentiment: AI evaluates news and social media trends to understand broader market sentiment, which can impact lending decisions and risk assessment.

Real-time borrower monitoring

- Ongoing assessment: AI continuously monitors borrowers’ financial health and market conditions, providing alerts for potential risks or opportunities for loan restructuring.

- Dynamic adjustments: AI can adjust loan terms and conditions dynamically based on real-time data, ensuring that loan agreements remain favorable for both parties.

Portfolio diversification strategies

- Risk diversification: AI helps lenders diversify their loan portfolios by identifying opportunities to spread risk across different sectors, geographies, and borrower types.

- Optimal allocation: AI provides insights on the optimal allocation of capital to maximize returns and minimize risk.

Information retrieval

- Extracting specific data: AI extracts specific questions or classifications from unstructured data, improving data accessibility and usability.

- Contextual understanding: AI algorithms analyze the context of information within unstructured data to enhance the accuracy of data retrieval, ensuring that extracted information is relevant and meaningful.

- Automated data tagging: AI automatically tags and categorizes information extracted from various sources, streamlining data organization and facilitating easier retrieval for future reference.

Legal document processing in loan underwriting

- Information gathering: AI processes and summarizes legal documents, such as loan agreements and borrower disclosures, facilitating compliance and more informed decision-making.

- Automated contract review: AI tools review and analyze loan contracts to identify key terms, risks, and compliance issues, ensuring that all contractual obligations are met and reducing the risk of errors in the underwriting process.

- Regulatory compliance verification: AI assists in verifying that all legal requirements and regulatory standards are met during the underwriting process, helping lenders comply with legal obligations and reduce the risk of non-compliance.

- Document organization and retrieval: AI organizes and classifies legal documents related to loan underwriting, such as terms and conditions, borrower agreements, and compliance documents, improving efficiency in document management and retrieval.

Compliance checks

- Automated compliance: AI performs automated checklist verifications and procedural follow-ups to ensure adherence to regulatory requirements.

- Real-time regulatory monitoring: AI continuously monitors regulatory changes and updates, automatically adjusting compliance procedures to align with the latest requirements and avoiding potential violations.

- Error detection and correction: AI identifies and flags potential compliance errors or inconsistencies in underwriting documents and processes, providing recommendations for corrections and ensuring accurate and compliant loan approvals.

- Audit trail generation: AI creates detailed audit trails of compliance checks and procedural actions, providing transparency and accountability for regulatory audits and reviews.

Training and double-checking

- Comprehensive training: AI assists in training processes and ensures verification through automated checks, enhancing accuracy and reliability.

- Simulated training scenarios: AI creates simulated scenarios for training purposes, allowing underwriters to practice handling various cases and improving their decision-making skills in a controlled environment.

- Performance analytics: AI analyzes training performance and accuracy, providing feedback and identifying areas for improvement, ensuring that underwriters are well-prepared and accurate in their evaluations.

- Automated error detection: AI reviews underwriting decisions and processes to detect and correct errors, providing a double-check mechanism that reduces the risk of human error and ensures higher-quality outcomes.

Reduced friction in commercial underwriting

- Streamlining processes: AI reduces friction by optimizing the scheduling of assets and coverages in commercial underwriting, improving efficiency.

- Automated risk assessment: AI automates the assessment of risks associated with commercial assets and coverages, allowing for faster and more accurate evaluations while minimizing manual intervention.

- Predictive analytics: AI uses predictive analytics to forecast potential risks and identify trends that could impact underwriting decisions, enabling more proactive and informed risk management.

- Enhanced coordination: AI facilitates better coordination between different departments and stakeholders involved in the underwriting process by automating communication and data sharing, reducing delays, and improving overall workflow.

These use cases demonstrate the transformative potential of AI in loan underwriting, highlighting its ability to improve efficiency, accuracy, and customer experience.

Streamlining loan underwriting processes with generative AI

Generative AI is transforming the loan underwriting process, automating tasks, streamlining workflows, and enhancing decision-making. Here’s a breakdown of the key processes and how generative AI is making a significant impact in each of the steps involved in these processes:

1. Loan application intake and screening

| Steps Involved | Sub-Steps | Role of Generative AI |

|---|---|---|

| Gather Basic Borrower Information |

|

|

| Validate Application Completeness |

|

|

| Assess Initial Eligibility |

|

|

2. Credit analysis and risk assessment

| Step | Sub-steps | Role of Generative AI |

|---|---|---|

| Evaluate Creditworthiness |

Assess:

|

|

| Risk Scoring |

Perform:

Determine risk category |

|

| Risk Mitigation |

|

|

| Loan Eligibility Check |

Check if the borrower is eligible for the loan |

|

3. Collateral valuation and regulatory compliance

| Steps Involved | Sub-Steps | Role of Generative AI |

|---|---|---|

| Collateral Risk Analysis |

|

|

| Collateral Approval |

|

|

| Compliance Review |

|

|

| Documentation |

|

|

4. Loan structuring & pricing

| Step | Sub-steps | Role of Generative AI |

|---|---|---|

| Structure Loan |

|

|

| Rate Modeling |

|

|

| Fee Structuring |

|

|

| Risk-Based Pricing |

|

|

5. Loan approval and disbursement

| Steps Involved | Sub-steps | Role of Generative AI |

|---|---|---|

| Document Generation |

|

|

| Verification Process |

|

|

| Loan Finalization |

|

|

| Approval Process |

|

|

| Completion |

|

|

Optimize Your Operations With AI Agents

Optimize your workflows with ZBrain AI agents that automate tasks and empower smarter, data-driven decisions.

How does LeewayHertz’s generative AI platform optimize loan underwriting processes?

LeewayHertz’s generative AI platform, ZBrain, plays a transformative role in empowering financial institutions by optimizing loan underwriting processes and facilitating swift, efficient loan approvals. As a comprehensive, enterprise-ready platform, ZBrain empowers businesses to design and implement applications tailored to their specific operational requirements. The platform uses clients’ data, whether in the form of text, images, or documents, to train advanced LLMs like GPT-4, Vicuna, Llama 2, or GPT-NeoX for developing contextually aware applications capable of performing diverse tasks.

Enterprises encounter a multifaceted challenge in loan underwriting, grappling with issues spanning data accuracy, regulatory compliance, risk assessment, fraud prevention, subjective decision-making, meticulous documentation management, and adapting to dynamic economic conditions. ZBrain effectively addresses these challenges through its distinctive feature called “Flow,” which provides an intuitive interface that allows users to create intricate business logic for their apps without the need for coding. Flow’s easy-to-use drag-and-drop interface enables the seamless integration of large language models, prompt templates, and other genAI models into your app’s logic for its easy conceptualization, creation, or modification.

To comprehensively understand how ZBrain Flow works, explore this resource that outlines a range of industry-specific Flow processes. This compilation highlights ZBrain’s adaptability and resilience, showcasing how the platform effectively meets the diverse needs of various industries, ensuring enterprises stay ahead in today’s rapidly evolving business landscape.

ZBrain applications facilitate organizations in elevating their loan underwriting workflows, resulting in heightened efficiency, accelerated decision-making, enhanced accuracy in risk assessment, robust fraud detection, cost reduction, consistent and fair application of underwriting criteria, improved customer experiences, and streamlined compliance management, all while upholding stringent data privacy standards.

LeewayHertz’s AI development services for loan underwriting

At LeewayHertz, we build AI solutions tailored to meet the specific needs of loan underwriting processes. Our strategic AI/ML consulting empowers financial institutions to leverage AI for improved decision-making, enhanced risk assessment, and optimized loan processing.

Our expertise in developing Proof of Concepts (PoCs) and Minimum Viable Products (MVPs) allows us to demonstrate the practical application of AI in the loan underwriting process. This allows institutions to test and refine AI-driven solutions for tasks like document verification, risk scoring, and automated decisioning, ensuring they are effective and meet the specific needs of their lending operations.

Our work in generative AI also transforms routine tasks like data analysis and document verification, automating these processes to free up underwriters for more strategic roles.

By fine-tuning large language models to the nuances of financial terminology and loan evaluation criteria, LeewayHertz enhances the accuracy and relevance of AI-driven underwriting processes.

Additionally, we ensure these AI systems integrate seamlessly with existing technological infrastructures, enhancing operational efficiency and decision-making in loan underwriting.

Our AI solutions development expertise

AI solutions development for loan underwriting typically involves creating systems that enhance decision-making, automate routine tasks, and personalize loan evaluations. These solutions integrate key components such as data aggregation technologies, which compile and analyze financial information from diverse sources. This comprehensive data foundation supports predictive analytics capabilities, enabling the accurate assessment of borrower risk profiles.

Additionally, machine learning algorithms are employed to evaluate loan applications based on various criteria, ensuring that each application is assessed accurately and efficiently. These solutions often cover areas like credit scoring, risk assessment, regulatory compliance, and loan portfolio management.

Overall, AI solutions in loan underwriting aim to optimize financial outcomes, improve efficiency, and elevate the client experience.

AI agent/copilot development for loan underwriting

LeewayHertz builds custom AI agents and copilots that enhance various loan underwriting operations, enabling companies to save time and resources while facilitating faster decision-making. Here is how they help:

Credit scoring and risk assessment:

- Automating the analysis of credit reports and financial statements to assess borrower risk.

- Utilizing predictive analytics to evaluate the likelihood of loan default.

- Enhancing the accuracy of credit scoring models by incorporating diverse data sources and advanced algorithms.

Application processing:

- Automating data entry and verification tasks to speed up the loan application process.

- Validating and cross-referencing application data against external databases to ensure accuracy.

- Streamlining the documentation process by automatically generating and categorizing required documents.

Fraud detection:

- Monitoring loan applications for predefined patterns or anomalies that indicate potential fraud.

- Flagging suspicious activities based on advanced machine learning models.

- Automating the review of flagged applications to ensure thorough and timely investigation.

Regulatory compliance:

- Automating compliance checks to ensure adherence to regulatory requirements.

- Monitoring loan portfolios for compliance with internal policies and external regulations.

- Generating compliance reports and documentation to facilitate regulatory audits.

Customer engagement:

- Offering 24/7 virtual assistance to handle customer inquiries and support requests.

- Automating routine communication tasks such as loan status updates and follow-ups.

- Analyzing customer interactions to provide personalized responses and recommendations.

Portfolio management:

- Analyzing loan portfolio performance to identify trends and potential risks.

- Recommending portfolio adjustments based on real-time data and predictive analytics.

- Automating portfolio rebalancing actions to maintain optimal risk levels.

Marketing and customer segmentation:

- Generating personalized marketing communications based on borrower data and preferences.

- Assisting with content creation for websites, social media, and marketing campaigns.

- Segmenting borrowers based on predefined criteria to target specific customer groups effectively.

Process automation:

- Automating repetitive tasks such as data entry, report generation, and document management.

- Streamlining the loan approval process by automating decision-making workflows.

- Enhancing operational efficiency by reducing manual intervention and errors.

AI agents/copilots not only increase the efficiency of operational processes but also significantly enhance the quality of customer service and strategic decision-making. By integrating these advanced AI solutions into their existing infrastructure, financial institutions can achieve a significant competitive advantage, navigating the complex financial landscape with innovative, efficient, and reliable AI-driven tools and strategies.

The operational advantages of AI in loan underwriting

The integration of AI in loan underwriting processes brings forth a multitude of benefits, redefining the efficiency, accuracy, and overall effectiveness of the lending industry:

Increased efficiency and speed: AI introduces automation to time-consuming underwriting tasks, significantly expediting the decision-making process. Real-time data analysis capabilities ensure prompt responses to borrower applications, contributing to a more agile and efficient lending workflow.

Improved accuracy and risk assessment: AI-powered models leverage extensive datasets to discern patterns and assess risk factors, resulting in heightened accuracy in predicting creditworthiness. This enhanced precision enables financial institutions to make well-informed lending decisions, minimizing the likelihood of defaults.

Personalized decision-making: The customization capabilities of AI in underwriting empower lenders to tailor decisions based on individual borrower profiles. This personalization extends to interest rates and loan terms, optimizing the lending experience for a diverse clientele.

Cost reduction: Through the automation of manual tasks, AI significantly reduces operational costs associated with underwriting processes. This efficiency in resource utilization leads to a more cost-effective and sustainable lending operation.

Adaptability to dynamic conditions: AI’s real-time adaptability to changing economic conditions ensures that underwriting models remain responsive to evolving market trends. The continuous learning mechanisms embedded in AI contribute to a dynamic and agile approach in the face of economic fluctuations.

Enhanced fraud detection: AI employs sophisticated algorithms to identify anomalies and detect potential fraud within loan applications. This heightened capability in fraud prevention contributes to a more secure lending environment, protecting both financial institutions and borrowers.

Streamlined document processing: Leveraging Natural Language Processing (NLP) and Computer Vision, AI streamlines the analysis of unstructured data and documents in loan applications. This not only accelerates document processing but also enhances accuracy, reducing reliance on manual efforts.

Increased objectivity and consistency: AI’s rule-based operation reduces the impact of human bias, fostering greater objectivity in lending decisions. Consistent application of predefined algorithms ensures fairness throughout the decision-making process, promoting a more impartial approach.

Scalability: AI-driven systems demonstrate scalability by efficiently managing large volumes of data and applications. This scalability is particularly valuable for financial institutions dealing with expanding loan portfolios, ensuring operational efficiency as the business grows.

Data-driven insights: AI’s data analytics capabilities generate actionable insights, empowering lenders with valuable information for strategic decision-making. This data-driven intelligence aids financial institutions in identifying trends, refining underwriting strategies, and staying ahead in a competitive market.

Enhanced customer experience: Faster processing times and personalized offerings contribute to an improved customer experience in the lending process. Transparent and efficient underwriting instills trust among borrowers, fostering positive relationships between financial institutions and their clientele.

Regulatory compliance: AI systems can be designed to ensure compliance with regulatory standards, reducing the risk of errors. Automated processes enhance precision in adhering to legal requirements, mitigating regulatory challenges faced by financial institutions.

The incorporation of AI into loan underwriting not only addresses the challenges of traditional methods but also introduces a range of benefits that collectively enhance the effectiveness and customer satisfaction within the lending industry.

AI technologies transforming loan underwriting

AI technologies play a crucial role in modernizing and improving the efficiency of loan underwriting processes. Here are some key AI technologies commonly used in loan underwriting:

Machine Learning (ML)

ML plays a crucial role in the modernization of loan underwriting processes, harnessing advanced algorithms and data analytics. In loan underwriting, ML algorithms are trained on extensive datasets to recognize patterns, assess risk factors, and predict creditworthiness. These algorithms can analyze diverse data points, including credit history, income, and financial behavior, providing a more nuanced evaluation of borrowers. ML facilitates real-time decision-making, enabling financial institutions to streamline the underwriting process, improve accuracy in risk assessment, and adapt dynamically to evolving economic conditions. By continuously learning and evolving, ML models contribute to more informed lending decisions, enhancing efficiency and responsiveness in the ever-changing landscape of loan underwriting.

Predictive analytics

Predictive analytics is a cornerstone of modern loan underwriting, harnessing data-driven insights to enhance decision-making processes. In this context, predictive analytics utilizes historical data and statistical algorithms to anticipate future trends and assess potential risks associated with borrowers. By analyzing patterns and relationships within vast datasets, predictive analytics enables financial institutions to evaluate creditworthiness more accurately, predict default probabilities, and optimize interest rates. This technology empowers lenders to make informed decisions, adapt to changing market conditions, and proactively manage risks. Ultimately, predictive analytics in loan underwriting contributes to a more precise, efficient, and forward-looking approach, aligning financial institutions with the evolving needs of the lending landscape.

Natural Language Processing (NLP)

Natural Language Processing (NLP) plays a transformative role in loan underwriting by enabling the analysis and interpretation of unstructured data, such as text. In this context, NLP algorithms process and understand information from various sources, including loan applications, financial statements, and even social media, to extract valuable insights. NLP assists in automating the extraction of relevant information, improving the speed and accuracy of underwriting processes. By comprehending the nuances of language and context, NLP contributes to more informed risk assessments, enhances due diligence, and streamlines the decision-making workflow in loan underwriting, ultimately fostering a more efficient and sophisticated approach to credit evaluation.

Computer vision

While less commonly applied in loan underwriting compared to other fields, computer vision holds the potential for automating document analysis. In this context, computer vision algorithms can visually interpret and extract information from documents such as bank statements, identification cards, and financial records. This technology aids in digitizing and processing physical documents, reducing manual efforts and improving the speed and accuracy of data extraction. Although its application in loan underwriting is evolving, computer vision has the capacity to enhance document verification processes, contributing to more efficient and reliable assessments of borrower information.

Utilizing these AI technologies enables lenders to streamline underwriting processes, improve accuracy, mitigate risks, and, ultimately, make well-informed decisions when extending credit to borrowers. However, it’s crucial to address ethical considerations, data privacy, and regulatory compliance when implementing AI in loan underwriting.

Best practices for implementing AI in loan underwriting

Implementing AI in loan underwriting can streamline processes, improve accuracy, and enhance decision-making. Here are some best practices to consider:

Define clear objectives and scope

Objective setting: Clearly define the objectives for implementing AI in loan underwriting, such as improving accuracy, speeding up processing times, or enhancing customer experience. Align AI initiatives with the organization’s strategic goals.

Scope management: Establish the scope of AI implementation, including which aspects of the underwriting process will be automated and how AI will integrate with existing systems.

Data management and quality

High-quality data: Ensure that the data used for training AI models is accurate, complete, and relevant. High-quality data is crucial for developing effective AI models.

Data privacy and compliance: Adhere to data privacy regulations and implement robust data protection measures. Regularly review and update data management practices to comply with legal requirements and safeguard sensitive information.

Model development and testing

Algorithm selection: Choose the right AI algorithms and models based on the specific needs and objectives of the underwriting process. Consider factors such as interpretability, scalability, and performance.

Rigorous testing: Conduct extensive testing of AI models to ensure their accuracy, reliability, and fairness. Use validation datasets and perform stress tests to assess the model’s performance under various scenarios.

Bias detection and mitigation

Bias audits: Regularly audit AI models for potential biases and take corrective actions to mitigate them. Use techniques like fairness-aware modeling and diverse datasets to promote unbiased decision-making.

Continuous monitoring: Implement ongoing monitoring to detect and address any emerging biases or disparities in AI-driven underwriting decisions.

Transparency and explainability

Explainable AI: Ensure that AI models are explainable and that their decisions can be understood by stakeholders. Provide clear explanations of how AI-generated decisions are made to maintain trust and accountability.

Documentation: Maintain thorough documentation of AI model development, including data sources, algorithm choices, and decision-making processes, to support transparency and future audits.

Human oversight and collaboration

Human-in-the-loop: Incorporate human oversight into the AI-driven underwriting process. Ensure that human underwriters can review and override AI decisions when necessary to ensure fairness and accuracy.

Cross-functional teams: Collaborate with cross-functional teams, including data scientists, compliance experts, and domain specialists, to ensure comprehensive development and implementation of AI solutions.

Regulatory compliance and ethical standards

Regulatory adherence: Stay informed about relevant regulations and industry standards related to AI and loan underwriting. Ensure that AI implementations comply with all legal and regulatory requirements.

Ethical considerations: Align AI practices with ethical standards and best practices to promote responsible and fair use of technology. Engage with industry groups and ethicists to guide the development and deployment of AI systems.

Continuous improvement and feedback

Iterative refinement: Continuously refine AI models based on performance feedback and evolving business needs. Implement iterative improvements to enhance model accuracy and effectiveness.

Feedback mechanisms: Establish feedback mechanisms to gather input from users and stakeholders about AI performance and outcomes. Use this feedback to make informed adjustments and improvements.

By following these best practices, financial institutions can leverage AI to enhance their loan underwriting processes while maintaining accuracy, compliance, and operational efficiency.

Optimize Your Operations With AI Agents

Optimize your workflows with ZBrain AI agents that automate tasks and empower smarter, data-driven decisions.

The future of AI in loan underwriting

The future of AI in loan underwriting holds exciting prospects as technology continues to evolve and financial institutions embrace innovative solutions. Here are key aspects shaping the future landscape:

Expanded use of alternative data: Financial institutions will increasingly leverage alternative data sources beyond traditional credit history. This may include social media activity, online behavior, and other non-traditional indicators, providing a more comprehensive view of an applicant’s financial behavior.

Continuous regulatory adaptation: Regulatory frameworks will adapt to address the distinct challenges introduced by AI in loan underwriting. Governments and regulatory bodies will collaborate to establish guidelines that strike a balance between harnessing the benefits of AI and safeguarding consumer rights, privacy, and equitable lending practices.

Increased focus on education and awareness: With the increasing reliance on AI, there will be a concerted effort to educate stakeholders, including borrowers, about how AI is used in loan underwriting. Transparent communication and awareness programs will be crucial for building trust in AI-driven financial processes.

Innovations in explainable AI: The development of more sophisticated explainability techniques will address the challenge of understanding complex AI models. This will be crucial in gaining trust from both regulatory bodies and the general public.

Cross-industry collaboration: Financial institutions, technology companies, and regulatory bodies will collaborate to share best practices and address common challenges associated with AI in loan underwriting. This collaborative approach will foster a more robust and ethical implementation of AI technologies.

The future of AI loan underwriting will be characterized by continued innovation, increased transparency, and a careful balance between automation and human expertise. As technology advances and regulatory frameworks adjust, AI will become a pivotal force in shaping a lending ecosystem that is more efficient, personalized, and responsible.

Endnote

The integration of AI in loan underwriting marks a paradigm shift in the financial sector, offering a myriad of benefits. AI’s data analysis capabilities allow for a more comprehensive and nuanced evaluation of borrowers, enabling lenders to make informed decisions with increased speed and accuracy. The automation of routine tasks expedites the underwriting process, reducing manual efforts and allowing financial institutions to allocate resources more efficiently. Moreover, AI-driven algorithms can assess risk factors in real-time, adapting to dynamic economic conditions and enhancing the precision of risk assessments. This not only streamlines the lending process but also contributes to more personalized and fair outcomes. The predictive power of AI models aids in identifying patterns and trends, optimizing decision-making and ultimately improving the overall efficiency of loan underwriting. While challenges exist, the transformative impact of AI in this domain underscores its potential to redefine and elevate the lending landscape, fostering innovation, inclusivity, and a more responsive financial ecosystem.

Elevate your underwriting capabilities by integrating AI. Partner with LeewayHertz for custom solutions that will redefine your loan underwriting processes, driving efficiency, precision, and a competitive edge for your business.

Start a conversation by filling the form

All information will be kept confidential.