AI for financial planning: Use cases, benefits and development

In today’s fast-paced world, the financial planning landscape is undergoing a seismic shift driven by rapid technological advancements. Financial planning has traditionally been a methodical and time-intensive process, requiring a manual analysis to understand market trends, personal financial data, and formulating long-term plans. Financial advisors and planners spent hours sifting through data, using historical knowledge and educated guesses to make forecasts and recommendations.

Enter the era of Artificial Intelligence (AI) and Machine Learning (ML), which are not just reshaping the fintech sector but transforming it. These technologies are more than mere trends; they represent a fundamental transformation in how financial data is analyzed and how wealth plans are formulated. With the capability to process and analyze data at an unprecedented scale and speed, AI is setting new standards in accuracy and efficiency. Its impact is so profound that it’s projected to save the banking industry a staggering $447 billion by 2023.

The integration of AI into financial planning marks a significant departure from traditional practices. Previously, financial advisors mainly used their own domain knowledge and experience to guide their work. Now, they can also use AI tools that offer detailed insights based on financial data analysis. These AI systems offer personalized financial advice, sophisticated market analysis, and predictive forecasting, all while automating routine and repetitive tasks. The integration of AI in financial planning extends beyond automations. It signifies a shift from traditional reliance on experience and intuition to embracing AI for deeper, data-driven insights. The result is a more efficient, cost-effective, and precise approach to financial planning.

As we explore this new landscape, we will see how AI is not just an addition to the financial sector but a transformative force. It’s enabling companies to provide high-quality wealth management services at a fraction of the cost, making AI-powered personalized financial advice accessible to clients anytime, anywhere. This shift is not just about keeping pace with technological advancements but about embracing a new paradigm in financial planning, where AI plays a central role. This article delves into a comprehensive overview of AI’s role in financial planning, insights into its technical aspects, its advantages, and what the future might hold in this field.

- What is AI in financial planning?

- The role of AI in financial planning

- How does AI in financial planning work?

- Applications of AI in financial planning

- How GenAI is personalizing and streamlining financial planning workflow

- How does LeewayHertz’s generative AI solution enhance financial planning?

- LeewayHertz’s AI development services for financial planning

- Technical aspects of AI in financial planning

- How to implement AI in financial planning?

- Benefits AI brings to financial planning

- The future of AI in financial planning

What is AI in financial planning?

AI in financial planning is a game-changer in how businesses approach their financial analysis and decision-making processes. Traditionally, financial planning teams delve into substantial amounts of data to gauge a company’s performance, forecast future trends, and plan for success. This task, often labor-intensive due to the vast data volumes and ever-changing market dynamics, is now being transformed by AI.

At the core of AI in financial planning are key technologies like machine learning, natural language processing (NLP), and predictive analytics.

- Machine learning allows AI systems to learn from and make predictions based on data, improving their accuracy over time.

- NLP enables these systems to understand and process human language, making it possible to analyze financial documents and reports efficiently.

- Predictive analytics use statistical methods to foresee future events based on historical data.

By harnessing these technologies, AI can rapidly process and interpret large amounts of financial data, uncover trends and patterns, and offer valuable insights. This capability is transforming financial planning tasks such as portfolio management, risk assessment, fraud detection, and providing personalized financial advice. AI’s ability to handle complex, voluminous data is changing the way financial institutions operate, making financial planning more efficient, accurate, and insightful. As a result, AI is not just a tool for enhancing financial planning; it’s reshaping the very fabric of financial strategy and decision-making in businesses.

Optimize Your Operations With AI Agents

Optimize your workflows with ZBrain AI agents that automate tasks and empower smarter, data-driven decisions.

The role of AI in financial planning

AI-enhanced assessment: Understanding financial situations in depth

In financial planning, both for individuals and corporations, the process typically involves a cycle that starts with assessing the current financial situation. This initial stage is crucial as it forms the foundation for developing a strategic plan and later evaluating its success. AI and machine learning technologies significantly enhance this stage by automating routine tasks and providing in-depth analysis.

The process begins with gathering detailed information about a person’s or company’s financial status. This includes data on income, expenses, asset portfolio, liabilities, insurance coverage, and, in personal cases, factors like health and family circumstances. Traditionally, this data is collected through questionnaires. However, AI extends this by pulling in additional data from various sources like bank account transactions, which provide insights into spending habits, and social media, which can offer clues about lifestyle and financial goals.

AI technologies, especially ML, excel in analyzing these diverse data sets. They employ advanced mathematical models that can draw more accurate and nuanced conclusions from the data than traditional manual methods. Machine learning algorithms are particularly adept at handling complex variables and can still provide reliable insights even when occasionally dealing with incomplete, corrupted, or unusual data.

By creating a more comprehensive client profile, AI enables more personalized and effective financial planning. It allows financial managers to understand their client’s or company’s current financial standing in greater depth, paving the way for more informed planning and investment strategies. This level of detailed analysis, powered by AI and ML, is transforming the first and one of the most critical steps in the financial planning process.

AI in goal setting: Streamlining financial objectives

After the initial assessment of financial status, the next crucial phase in financial planning is setting clear, attainable goals. These objectives can vary widely, ranging from achieving a specific return rate on investments to saving for a major purchase or planning for retirement. An essential aspect of this stage is prioritizing these goals and defining a timeline for achieving them.

AI plays a pivotal role in this process. Leveraging the data collected in the initial profiling step, AI models can effectively assist in charting a path towards these financial goals. They do this by analyzing current income and spending patterns and projecting how these will impact the ability to meet set objectives. AI systems can simulate various scenarios, considering individual risk-taking tendencies influenced by age and specific financial goals. This includes analyzing the impact of maintaining current financial habits or making targeted changes to predict the time needed to achieve each goal.

This AI-driven approach to goal setting in financial planning not only provides a more personalized strategy but also offers a realistic view of what can be achieved and in what timeframe. Incorporating AI into this process makes financial planning more targeted, efficient, and aligned with individual or corporate financial aspirations.

AI-driven strategy development in financial planning

Once a comprehensive understanding of a client’s financial situation and goals is established, AI offers personalized financial planning and wealth management advice. AI-powered financial applications, equipped with machine learning capabilities, offer several advantages over traditional human advisors: they are unbiased, offer real-time advice, are infinitely scalable, and generally incur lower costs. These factors collectively make them particularly suitable for individuals new to investing or those without substantial funds.

AI in financial planning goes beyond simple advice. When selecting investment options, AI can meticulously analyze numerous factors. This includes assessing the risks associated with securities, understanding bond credit ratings, considering portfolio size, and evaluating diversification needs. It also takes into account tax implications and more. Artificial Neural Networks are used extensively for predicting stock market trends by examining past price patterns, including highs, lows, and closing prices.

Furthermore, integrating Natural Language Processing allows AI to gauge public sentiment about companies by analyzing media content. This combination of predictive analysis and sentiment assessment enables AI to provide even more accurate recommendations on stocks and bonds.

AI offers digital financial planning solutions for businesses, identifying assets at risk due to market fluctuations or projecting the impact of political and social events on company assets. AI enhances financial planning by analyzing various policies to recommend the most suitable and personalized insurance plans in the insurance sector.

In summary, AI transforms financial planning by developing tailored investment, business asset management, and insurance selection strategies. This holistic, AI-enabled approach ensures that both individual investors and businesses can make more informed and effective financial decisions.

AI in continuous performance monitoring and analysis in financial planning

Once a financial plan is in action, the process doesn’t simply halt. Given today’s dynamic market conditions, monitoring performance and constantly adjusting plans as needed is crucial. AI is exceptionally well-suited for this ongoing task.

AI models can swiftly process large volumes of data, turning complex information into easily understandable reports, both text-based and visual. Unlike humans, who may inadvertently focus on specific aspects while overlooking others, AI maintains a comprehensive view, paying attention to even the minutest details. This capability is invaluable in safeguarding corporate interests and predicting risks using methods like the Monte Carlo simulation (a risk-probability analysis technique) and other advanced algorithms.

AI tools provide financial managers with an up-to-date picture of their financial standing, enabling informed decision-making. Beyond just analysis, AI financial advisors can also take proactive steps. For instance, a financial advisor in an investment app can assess a client’s portfolio performance and autonomously adjust it to align with their financial goals. This includes rebalancing investments to ensure optimal asset allocation.

Moreover, AI in financial planning is adept at considering nuances and data points that might be overlooked due to urgency or market volatility. It can minimize operations to avoid unnecessary fees and navigate complex regulations, like the IRS wash-sale rule that prohibits repurchasing a similar stock within 30 days of selling it.

AI’s role in monitoring and analyzing financial performance is multifaceted. It not only provides comprehensive and detailed insights but also actively manages and adjusts financial strategies to keep them aligned with set objectives, all while navigating market complexities and regulatory requirements.

How does AI in financial planning work?

Incorporating AI into financial planning processes involves various components to streamline data analysis, generate insights, and support decision-making. It goes beyond traditional methods by using powerful large language models (LLMs) connected with an organization’s unique knowledge base. This approach, known as Retrieval-augmented Generation (RAG), unlocks new levels of insight generation, empowering individuals and businesses to make real-time data-driven financial decisions.

The RAG architecture leverages various components to streamline the financial planning process. Here’s a step-by-step breakdown of how it works:

- Data sources: The process begins by gathering data from various sources relevant to the financial planning process. This data can include:

- Personal financial data: Information on income, expenses, assets, liabilities, and cash flow.

- Investment data: Historical and real-time data on stocks, bonds, mutual funds, and other investment vehicles.

- Market data: Trends and performance metrics from financial markets, including stock exchanges and commodity markets.

- Regulatory information: Updates on tax laws, financial regulations, and compliance requirements.

- Data pipelines: Data from the above sources are routed through data pipelines, which handle the ingestion, cleaning, and structuring of the data to prepare it for further analysis.

- Embedding model: The processed data is then handled by an embedding model, which converts textual data into numerical representations and vectors that AI models can comprehend. OpenAI, Google, and Cohere provide popular embedding models.

- Vector database: The generated vectors are stored in a vector database, enabling efficient querying and retrieval. Notable examples of vector databases include Pinecone, Weaviate, and PGvector.

- APIs and plugins: APIs and plugins like Serp, Zapier, and Wolfram are crucial for connecting various components and enabling additional functionalities, such as accessing extra data or performing specific tasks with ease.

- Orchestration layer: The orchestrating layer is essential for managing the workflow. One example is ZBrain, which simplifies prompt chaining, manages interactions with external APIs, determines when API calls are necessary, retrieves contextual data from vector databases, and maintains memory across multiple LLM calls. Ultimately, this layer generates prompts or a series of prompts submitted to a language model for processing. It orchestrates data flow and tasks, ensuring seamless coordination across all financial planning components.

- Query execution: The data retrieval and generation process commences when a user submits a query to the due diligence app, covering various aspects relevant to the target company, including its financial health, legal compliance, or operational risks.

- LLM processing: Upon receipt, the app forwards the query to the orchestration layer, where ZBrain retrieves pertinent data from the vector database and LLM cache and directs it to the suitable LLM for processing based on the query’s nature.

- Output: The LLM produces an output derived from the query and received data, including summaries of factual information, identification of potential risks, or creating draft reports.

- Due diligence app: The validated output is presented to the user via the financial planning app, serving as the core application where all data, analysis, and insights converge. Findings are presented in a user-friendly format tailored for decision-makers.

- Feedback loop: User feedback on the LLM’s output is integral to this architecture and is utilized to enhance the accuracy and relevance of the LLM output progressively.

- Agent: AI agents are pivotal in addressing complex problems, interacting with the external environment, and enhancing learning through post-deployment experiences. They employ advanced reasoning and planning, strategic tool utilization, leveraging memory, recursion, and self-reflection.

- LLM cache: Tools like Redis, SQLite, or GPTCache cache frequently accessed information, thereby accelerating the AI system’s response time.

- Logging/LLMOps: Throughout this process, LLMOps tools like Weights & Biases, MLflow, Helicone, and Prompt Layer facilitate logging actions and monitoring performance. This ensures that LLMs operate optimally and continuously enhance through feedback loops.

- Validation: A validation layer is utilized to validate the LLM’s output, accomplished through Guardrails, Rebuff, Guidance, and LMQL. This ensures the accuracy and reliability of the information provided.

- LLM APIs and hosting: LLM APIs and hosting platforms are pivotal for executing financial planning tasks and hosting the application. Developers can choose from LLM APIs such as OpenAI and Anthropic or explore open-source models. Similarly, they can select hosting platforms from cloud providers like AWS, GCP, Azure, and Coreweave or consider opinionated clouds like Databricks, Mosaic, and Anyscale. The choice of LLM APIs and cloud hosting depends on the project’s requirements and preferences.

This structured flow outlines how AI enhances financial planning by harnessing diverse data sources and technological tools to generate precise and actionable insights. AI streamlines tasks, boosts efficiency, and enables comprehensive analysis, automating processes and facilitating informed decision-making in financial planning.

Optimize Your Operations With AI Agents

Optimize your workflows with ZBrain AI agents that automate tasks and empower smarter, data-driven decisions.

Applications of AI in financial planning

AI offers several impactful use cases in financial planning, including:

Personalized financial advice

AI-powered robo-advisors examine your financial details, investment goals, risk tolerance, and market trends. They then create personalized investment plans and offer tailored financial advice to suit your needs. Utilizing sophisticated algorithms, robo-advisors aim to optimize portfolios, mitigate risks, and seize opportunities in line with your objectives, empowering you to make well-informed decisions regarding your financial future.

Risk management

AI algorithms analyze market trends, economic data, and geopolitical factors to anticipate potential risks and opportunities. This assists financial planners in crafting effective risk management strategies for client portfolios. By leveraging AI-driven insights, planners can make informed decisions to safeguard investments and capitalize on market opportunities, ensuring the long-term financial health of their client’s portfolios.

Fraud detection and prevention

AI algorithms process large volumes of transaction data in real time to pinpoint unusual patterns or irregularities that could signify fraudulent activities. This capability empowers financial institutions to proactively detect and prevent fraud, safeguarding their clients’ assets. By leveraging AI-driven fraud detection systems, institutions can change security measures and uphold the integrity of financial transactions, thereby nurturing trust and confidence among their clients.

Portfolio optimization

AI models enhance investment portfolio optimization by analyzing asset correlations, historical performance data, and risk profiles. This analysis enables investors to maximize returns while minimizing risk, aligning with their financial goals more efficiently. By leveraging AI-driven portfolio optimization techniques, investors can build well-diversified portfolios tailored to their risk tolerance and investment objectives, ultimately enhancing the likelihood of long-term financial success.

Behavioral finance analysis

AI examines investor behavior, sentiment analysis of news, social media, and psychological biases to offer insights into market trends and investor sentiment, aiding financial planners in making informed decisions. Using AI-driven sentiment analysis tools, planners can acquire valuable insights into market dynamics, investor sentiment, and potential risks. This enables them to craft effective investment strategies and mitigate market volatility adeptly. This comprehensive understanding of investor behavior enhances the ability of financial planners to navigate the complexities of the market and optimize client portfolios for long-term success.

AI-powered chatbots

AI-powered chatbots manage customer inquiries, offer account information, and deliver basic financial guidance around the clock, boosting customer service and interaction while lowering operational expenses for financial institutions. These chatbots streamline customer support, providing instant responses to queries, assisting with account-related tasks, and offering personalized financial advice, thereby improving overall customer satisfaction and loyalty. AI-powered chatbots optimize operational efficiency and elevate the customer experience in the financial sector by automating routine tasks and delivering efficient customer service.

Financial forecasting

These insights aid businesses and individuals in making informed decisions regarding budgeting, investment strategies, and risk management. By leveraging AI-driven predictive analytics, stakeholders can anticipate market fluctuations, identify potential opportunities, and mitigate risks effectively, ultimately enhancing financial planning and decision-making processes for long-term success.

Regulatory compliance

AI plays a crucial role in financial planning by automating compliance tasks. It achieves this by meticulously analyzing regulatory requirements and monitoring transactions for irregularities or suspicious activities. By ensuring adherence to regulatory standards, AI helps financial institutions maintain compliance, mitigating the risk of penalties and legal repercussions. This automation streamlines the compliance process, allowing financial planners to focus on strategic aspects of financial planning, such as portfolio optimization, risk management, and investment strategy development. Thus, it ultimately enhances financial planning initiatives’ overall effectiveness and efficiency.

Expense tracking and budgeting

AI-powered tools are instrumental in financial planning by analyzing spending habits, categorizing expenses, and offering insights into budget management. These tools aid individuals and businesses in tracking expenses, identifying areas for savings, and managing cash flow effectively. By leveraging AI-driven analysis, users understand their financial behavior comprehensively, allowing them to make informed decisions to achieve their financial goals. This capability enhances financial planning by providing actionable insights that empower users to optimize their spending habits, increase savings, and achieve greater financial stability in the long run.

Retirement planning

AI algorithms play a pivotal role in financial planning for retirement by analyzing various factors such as age, income, retirement goals, life expectancy, and prevailing market conditions. By leveraging this data, AI can develop personalized retirement plans tailored to individual needs. These plans encompass savings goals, investment strategies, and withdrawal strategies, ensuring that individuals can achieve financial security in retirement. AI empowers financial planners to make informed decisions and plan effectively for retirement by offering personalized recommendations derived from comprehensive data analysis. This enhances their financial well-being and peace of mind.

Tax optimization

AI’s analysis of tax laws, deductions, credits, and individual financial situations is pertinent to financial planning. By leveraging this analysis, individuals and businesses can optimize their tax strategies as part of their broader financial plan. This includes identifying opportunities to minimize tax liabilities, maximize deductions, and implement tax-efficient investment strategies. Integrating tax optimization into financial planning helps individuals and businesses achieve their financial goals more effectively by maximizing after-tax returns and preserving wealth.

Dynamic pricing

AI algorithms dynamically analyze market demand, competitor pricing, customer behavior, and other variables to optimize pricing strategies. This allows businesses to maximize profitability while maintaining competitiveness in the e-commerce and retail sectors. By leveraging AI-driven pricing optimization, businesses can adapt their pricing strategies in real time based on market dynamics and customer preferences, ultimately enhancing their financial performance and market position. This capability empowers businesses to make data-driven pricing decisions that match their financial objectives and business goals, ultimately driving sustainable growth and profitability.

Credit risk assessment

AI models are integral to financial planning. They analyze credit application data, payment history, and credit bureau information to assess credit risk accurately. This allows lenders to make informed decisions about extending credit, setting interest rates, and managing credit portfolios efficiently. By leveraging AI-driven credit risk assessment, lenders can evaluate creditworthiness more accurately, reducing the risk of default and optimizing their lending practices. This capability empowers lenders to make data-driven decisions that match their financial objectives and risk tolerance, ultimately enhancing their financial performance and stability.

Predictive analytics for investment

AI models analyze past market data and other information to predict future market trends and asset prices. This enables investors to make better investment decisions and earn higher returns in financial markets. Using AI-driven predictions, investors can understand market dynamics, identify opportunities, and manage risks effectively. This allows them to make informed decisions aligned with their goals and risk tolerance, improving their chances of success in investing.

Natural Language Processing (NLP) for financial analysis

AI-powered NLP tools analyze various sources, such as news articles, earnings reports, analyst opinions, and social media, to extract insights and sentiment analysis. Understanding market sentiment helps financial analysts make timely and informed investment decisions. By leveraging AI-driven sentiment analysis, analysts can gauge market sentiment accurately, identify emerging trends, and anticipate market movements. This enables them to make informed decisions aligned with investment goals and market conditions, ultimately improving their investment strategies and outcomes.

These use cases demonstrate how AI enhances financial planning by leveraging advanced algorithms, data analytics, and automation to deliver more personalized, efficient, and accurate financial services.

Optimize Your Operations With AI Agents

Optimize your workflows with ZBrain AI agents that automate tasks and empower smarter, data-driven decisions.

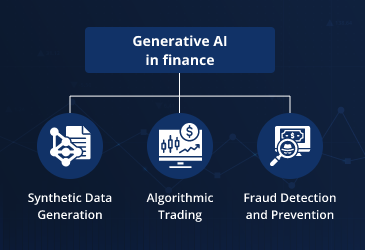

How GenAI is personalizing and streamlining financial planning workflow

Streamlining financial planning workflow with generative AI transforms how organizations manage risks, ensure compliance, and enhance decision-making, driving greater efficiency and accuracy in every step of the financial planning process. Let’s understand in detail the role of generative AI at every stage of financial planning workflow:

Client onboarding

| Steps involved | Sub-steps involved | Role of Generative AI |

|---|---|---|

| Client information gathering |

|

|

| Preliminary financial goal-setting |

|

|

Financial need analysis

| Steps involved | Sub-steps involved | Role of Generative AI |

|---|---|---|

| Financial assessment |

|

|

| Gap analysis |

|

|

| Action plan development |

|

|

Financial planning and review

| Steps involved | Sub-steps involved | Role of Generative AI |

|---|---|---|

| Define financial goals |

|

|

| Analyze the current financial situation |

|

|

| Develop financial strategies |

|

|

| Monitor and review |

|

|

| Prepare reports |

|

|

Portfolio management

| Steps involved | Sub-steps involved | Role of Generative AI |

|---|---|---|

| Asset allocation |

|

|

| Portfolio construction |

|

|

| Performance monitoring |

|

|

| Portfolio rebalancing |

|

|

Risk assessment and compliance

| Steps involved | Sub-steps involved | Role of Generative AI |

|---|---|---|

| Risk evaluation |

|

|

| Compliance implementation |

|

|

| Monitoring and reporting |

|

|

How does LeewayHertz’s generative AI solution enhance financial planning?

LeewayHertz’s proprietary generative AI platform, ZBrain, offers significant advantages for financial planning. You can leverage it to craft tailor-made applications using advanced Large Language Models (LLMs) trained on your proprietary data. ZBrain adeptly sources data in diverse forms, including texts, images, and documents, and uses it to train LLMs like GPT-4, Vicuna, Llama 2, and GPT-NeoX to create powerful apps that help you refine decision-making, deepen analytical insights, and enhance productivity, all while upholding stringent data privacy standards. It’s an ideal tool for transforming finance and banking operations into smarter, data-driven systems.

Issues such as complex risk assessment, slow customer service, and inefficient data processing are prevalent in the financial sector. ZBrain adeptly tackles these challenges with its specialized “Flow” feature, which enables straightforward, no-code development of business logic for apps through its easy-to-use interface. It offers various prompt templates, large language models and other generative Ai models to choose from, streamlining the creation and customization of intelligent applications.

This comprehensive approach effectively solves critical challenges faced during financial planning, ensuring improved risk management, faster customer response, and more efficient data handling. Here are a few examples of how ZBrain helps streamline and simplify such tasks-

AI-powered financial risk management

ZBrain effectively addresses risk management and analysis challenges in the financial sector. By enabling users to build LLM-based applications, the GenAI platform facilitates risk assessment with accurate prediction and analysis of potential financial risks. This advanced approach leads to highly effective risk management strategies, reducing uncertainties and optimizing decision-making processes. To understand how ZBrain transforms risk management and analysis, explore the detailed Flow process here.

AI-powered operational efficiency analysis

ZBrain adeptly tackles operational efficiency challenges in the financial sector. Robust LLM-based applications built on ZBrain facilitate thorough analysis of operational processes and the identification of areas that need improvement. These apps’ advanced capabilities enhance process optimization, resulting in significant operational cost savings, reduced inefficiencies, and increased overall productivity. To understand how ZBrain transforms operational efficiency through AI-driven analysis and offers tangible benefits to businesses, you can delve into the specific Flow detailed on this page.

AI-driven contract analysis

ZBrain effectively transforms contract analysis through its GenAI applications. ZBrain’s LLM-based apps streamline the process of scrutinizing and understanding complex contractual documents. This innovation results in considerable time savings, reduces the potential for human error, and enhances the accuracy of contract interpretations. By implementing ZBrain apps, businesses benefit from more efficient and accurate contract analysis, leading to improved compliance, risk management, and decision-making. For a detailed insight into how ZBrain transforms contract analysis with its GenAI apps, you can explore the specific Flow detailed on this page.

AI-driven customer churn analysis

ZBrain effectively addresses customer churn analysis challenges in finance. With its LLM-based apps, ZBrain provides in-depth insights into customer behavior and churn patterns. This enables businesses to identify and address factors that lead to customer attrition. The benefits of implementing ZBrain include improved customer retention strategies, enhanced understanding of customer needs, and, ultimately, increased customer loyalty and satisfaction. For a closer look at how ZBrain empowers businesses with advanced churn analysis and helps maintain a robust customer base, you can check out the detailed Flow on this page.

AI-enhanced budget analysis

ZBrain has innovatively addressed budget analysis challenges across financial sectors. With its LLM-based apps, ZBrain enhances the accuracy and efficiency of budget analysis. The apps aid businesses in optimizing their budget allocation, identifying cost-saving opportunities, and making data-driven financial decisions. The implementation of ZBrain apps into workflows results in improved financial planning, reduced expenditures, and enhanced overall fiscal management. To gain a comprehensive understanding of how ZBrain transforms budget analysis and contributes to effective financial strategies, you can go through the detailed Flow available on this page.

LeewayHertz’s AI development services for financial planning

At LeewayHertz, we specialize in crafting tailored AI solutions specifically for financial planning services. We provide strategic AI/ML consulting that enables financial planners to harness AI for enhanced decision-making, improved client engagement, and optimized financial strategies.

Our expertise in developing Proof of Concepts (PoCs) and Minimum Viable Products (MVPs) allows firms to preview the potential impacts of AI tools in real scenarios, ensuring that the solutions are both effective and tailored to the financial planning sector’s specific needs.

Our work in generative AI also transforms routine tasks like financial report generation and data management, automating these processes to free up advisors for more strategic roles.

By fine-tuning large language models to the nuances of financial terminology and client interactions, LeewayHertz enhances the accuracy and relevance of AI-driven communications and analyses.

Additionally, we ensure these AI systems integrate seamlessly with existing technological infrastructures, enhancing operational efficiency and decision-making in financial planning services.

Our AI solutions development expertise

AI solutions development for financial planning services involves creating systems that enhance decision-making, automate routine tasks, and personalize client interactions. These solutions integrate key components such as data aggregation technologies, which compile and analyze financial information from diverse sources. This comprehensive data foundation supports predictive analytics capabilities, allowing for the forecasting of financial trends that inform strategic decisions.

Additionally, machine learning algorithms are employed to tailor financial strategies to individual client profiles, ensuring that each client’s unique financial goals and risk tolerance are considered. These solutions often cover areas like financial plan generation, risk assessment, regulatory compliance, and client relationship management.

Overall, AI solutions in financial planning aim to optimize financial outcomes, improve efficiency, and elevate the client experience.

AI agent/copilot development for financial planning

LeewayHertz builds custom AI agents and copilots tailored to enhance various financial planning services, enabling companies to save time and resources while facilitating faster decision-making. Here is how they help:

Data aggregation and analysis:

- Aggregating and analyzing financial data from diverse sources to provide financial planners with a holistic view of their clients’ financial situations.

- Utilizing AI to forecast financial trends and market conditions, aiding strategic financial decisions.

Client engagement:

- Analyzing client data and past interactions to provide tailored financial advice and recommendations.

- Handling routine communication tasks like appointment reminders and financial plan updates and offering 24/7 virtual assistance for client queries.

Financial plan customization:

- Customizing financial plans based on individual client goals, risk tolerance, and financial situations to ensure personalized and relevant advice.

- Providing real-time insights into market conditions and asset performance to support timely and informed decision-making.

Regulatory compliance and risk monitoring:

- Ensuring compliance with evolving regulations through automated regulatory document analysis.

- Monitoring financial portfolios for compliance with predefined rules and policies and flagging potential compliance violations or discrepancies.

Process automation:

- Automating repetitive tasks such as data entry, report generation, and data validation to increase efficiency.

- Streamlining client onboarding and Know Your Customer (KYC) processes through automation.

Asset allocation and rebalancing:

- Recommending asset allocation strategies based on predefined models or rules and identifying imbalances in portfolios for rebalancing actions within defined thresholds.

Fraud detection:

- Monitoring financial transactions for patterns or rules associated with potential fraud and flagging suspicious activities based on predefined criteria.

Financial education and client communication:

- Analyzing client data (age, income, risk tolerance, goals) and generating personalized financial education materials, like articles, guides, or videos, explaining complex concepts in a clear and accessible way. This helps build client understanding and trust.

- Identifying relevant financial education content based on a client’s individual needs and goals. This can involve providing tailored insights on saving, investing, retirement planning, or other financial topics.

- Creating and sending personalized email newsletters, updates, and notifications about market trends, investment performance, or upcoming deadlines related to their financial plans. This keeps clients informed and engaged.

- Assisting in developing interactive tools and calculators that help clients understand financial concepts, estimate future outcomes, or explore different planning scenarios. This can make financial planning more engaging and accessible.

Customer segmentation and targeting:

- Analyzing client data to segment customers based on predefined criteria like demographics, risk profiles, and investment preferences.

- Identifying potential cross-selling or upselling opportunities based on customer segments.

AI agents and copilots not only increase the efficiency of financial operations but also significantly enhance the quality of client service and strategic decision-making. Financial planning firms can achieve a significant competitive advantage by integrating these advanced AI solutions into their existing infrastructure, navigating the complex financial landscape with innovative, efficient, and reliable AI-driven tools and strategies.

Technical aspects of AI in financial planning

The integration of AI in financial planning is not just about automation but also about the sophisticated interplay of advanced technologies and data. Let’s delve into the key technical aspects of AI in financial planning, from complex algorithms to data security and privacy concerns.

Algorithms and models in financial AI tools

A critical aspect of AI in financial planning is the use of sophisticated algorithms and models. Key among these are regression analysis and neural networks. Regression analysis helps in predicting financial trends by identifying relationships between different variables. For instance, it can show how changes in the stock market could affect investment portfolios. Neural networks, a subset of machine learning, mimic human brain functioning to process complex data sets. They are invaluable in recognizing patterns and making predictions based on historical financial data, which is essential in investment strategy formulation and risk assessment.

Data sources and integration

The effectiveness of AI in financial planning largely depends on the quality and breadth of data it analyzes. AI systems draw data from a variety of sources, including stock market feeds, economic reports, company financial statements, and even global news events that might impact financial markets. The integration of this data is crucial. AI systems are designed to aggregate and harmonize data from these disparate sources, creating a comprehensive dataset for analysis. This integrated approach allows for more accurate and holistic financial insights.

Security and privacy in AI-driven financial planning

As AI systems handle sensitive financial data, security and privacy are paramount. AI-driven financial planning tools must comply with regulatory standards like the General Data Protection Regulation (GDPR) and others that govern financial data handling. These tools use advanced encryption and authentication mechanisms to secure data against unauthorized access. Additionally, AI models are developed with privacy considerations in mind, ensuring that personal and financial data is processed and stored securely, maintaining client confidentiality.

In conclusion, the technical aspects of AI in financial planning involve:

- Sophisticated algorithms for data analysis.

- The integration of diverse data sources for a complete financial picture.

- Stringent security and privacy protocols to protect sensitive information.

Understanding these technical underpinnings is crucial for effectively harnessing AI’s potential in financial planning.

Benefits AI brings to financial planning

The advent of Artificial Intelligence in financial planning brings a multitude of benefits that transform the way financial strategies are formulated and executed. Let’s explore these benefits in detail:

- Rapid processing of large data sets: AI’s ability to quickly process vast datasets is a game-changer. It enables thorough and accurate data analysis, ensuring that financial decisions are based on solid, data-driven insights. This speed and accuracy in handling data are pivotal in today’s fast-paced financial environment.

- Enhanced collaboration across teams: AI in financial planning fosters inter-department collaboration, enabling swift access to vast data, insightful analysis, and efficient decision-making for optimized financial strategies. It allows teams to quickly access data for deeper financial insights, improved decision-making, and efficient collaboration, leading to optimized strategies.

- Superior efficiency in financial analysis: AI dramatically outperforms human capabilities in terms of the speed and accuracy of financial analysis. This efficiency boost not only speeds up the process but also enhances the overall quality of financial planning.

- Cost savings and efficient use of human resources: By automating routine and repetitive tasks, AI reduces the need for manual labor. This not only leads to cost savings but also allows human resources to be allocated to more complex and strategic tasks, maximizing workforce efficiency.

- Predictive insights and investment opportunities: AI’s ability to analyze historical market conditions and current trends enables it to predict future market performance accurately. These insights can uncover new investment opportunities, providing a strategic advantage in financial planning.

- Effective risk management: AI’s advanced analysis capabilities aid in identifying and managing financial risks more effectively. By recognizing patterns and trends, AI can anticipate potential risks and suggest mitigation strategies.

- Personalized financial advice: AI solutions can tailor financial advice to individual needs, considering each person’s goals, risk tolerance, and financial situation. This personalized approach ensures that financial planning is aligned with personal objectives.

- 24/7 customer support through AI tools: AI-powered chatbots and virtual assistants offer round-the-clock customer support. This ensures that clients have continuous access to assistance and information, enhancing the client service experience.

- Competitive advantage for businesses: AI’s quick response to market changes enables businesses to adapt swiftly. This agility is crucial in maintaining a competitive edge, as AI tools can quickly analyze market shifts and help businesses adjust their strategies accordingly.

In summary, AI in financial planning not only streamlines and enhances the analytical processes but also brings a strategic edge through predictive insights, personalized advice, effective risk management, and improved customer support. These benefits collectively lead to more efficient, accurate, and innovative financial planning practices.

How to implement AI in a financial planning system?

Implementing AI in a financial planning system involves several key steps:

- Identify objectives: Define the objectives and goals of integrating AI into the financial planning system. Determine the specific tasks or processes within financial planning that could benefit from AI capabilities.

- Data collection and preparation: Gather relevant financial data, including historical market data, customer information, and transactional data. Ensure that the data is clean, organized, and suitable for analysis.

- Algorithm selection: Based on the financial planning system’s objectives and requirements, choose appropriate AI algorithms and models. Consider factors such as the data’s complexity, the desired accuracy level, and available computational resources.

- Model training: Utilize the collected data to train the selected AI models. Depending on the problem’s nature, this may involve supervised learning, unsupervised learning, or reinforcement learning techniques.

- Development: Develop the AI-powered financial planning system, including coding, testing, and iterating to ensure that the system meets the specified requirements. This stage involves building the infrastructure and user interfaces and integrating AI models into the system.

- Integration: Integrate the trained AI models into the financial planning system. Creating APIs or interfaces might be necessary to facilitate smooth communication among AI models and other system elements.

- Testing and validation: Test the AI models to ensure they perform accurately and reliably under various scenarios. Validate the results against known outcomes or expert judgment to verify the effectiveness of the models.

- Deployment: Deploy the AI-powered financial planning system into production. Monitor the system’s performance in real-world settings and make any necessary adjustments or refinements.

- Continued improvement: Continuously monitor and evaluate the performance of the AI models over time. Gather user and stakeholder feedback to pinpoint areas for enhancement and apply updates accordingly.

- Compliance and security: Ensure that the AI-powered financial planning system complies with relevant regulations and security standards. Implement measures to protect sensitive financial data and mitigate risks associated with AI algorithms.

- Training and support: Provide training and support to users of the AI-powered financial planning system. Effectively utilize the system by understanding outputs, assessing risks, conducting scenario analysis, collaborating, prioritizing continuous learning, and monitoring performance for informed decision-making.

By following these steps, organizations can successfully implement AI in their financial planning systems, unlocking new capabilities and improving decision-making processes.

The future of AI in financial planning

The future of AI in financial planning is poised to be transformative, marked by emerging trends and new directions that will shape the landscape of financial strategy and management.

- Advanced predictive analytics: One of the significant future trends in AI-driven financial planning is the advancement in predictive analytics. This involves using sophisticated AI algorithms to analyze current and historical data to predict future financial trends and market behaviors. The evolution of these analytics will allow financial planners to make more accurate forecasts, tailor investment strategies to individual needs, and identify potential risks and opportunities with greater precision.

- Integration with blockchain technology: Another exciting development is the integration of AI with blockchain technology. Blockchain’s inherent transparency, security, and decentralization features, combined with AI’s analytical power, can transform financial transactions and record-keeping. This synergy could lead to more secure and efficient handling of financial data, enhance trust in financial transactions, and open new avenues for financial products and services.

- Shaping financial planning standards and practices: AI is also set to play a crucial role in setting new standards and practices in financial planning. As AI technologies become more ingrained in the financial sector, they will likely drive changes in regulatory frameworks and industry best practices. Financial planners will need to adapt to these new standards, which will emphasize data-driven decision-making, automated compliance checks, and enhanced client-centric approaches.

- Personalized financial solutions: Financial planning services will become increasingly personalized with continued advancements in AI. AI systems will be able to analyze individual client profiles in greater depth, considering not just financial data but also personal preferences and behaviors. This will enable the creation of highly customized financial plans that align closely with individual goals and risk tolerance.

- AI in risk management and compliance: AI’s future also includes improved risk management and regulatory compliance capabilities. By analyzing market trends and regulatory updates, AI can help financial institutions mitigate risks and ensure compliance with ever-evolving financial regulations.

- Democratization of financial planning: As AI tools become more accessible and user-friendly, AI-driven financial planning is expected to become more democratized. This means that advanced financial advice and planning tools will be available to a broader range of clients, not just high-net-worth individuals or large corporations.

In conclusion, the future of AI in financial planning is characterized by advanced analytics, innovative technology integrations, and a profound impact on industry standards and practices. These developments will lead to more efficient, secure, and personalized financial planning, fundamentally reshaping how financial advice is given and received.

Endnote

In summarizing our discussion about AI in financial planning, it’s clear that AI and ML are crucial allies for both individuals and businesses in their financial journeys. The capabilities of AI, compared to traditional human financial managers, are unparalleled. With infinite scalability, AI systems become more cost-effective and intelligent as they process more data and serve more clients. They offer precise analysis of complex financial metrics, providing deep insights into risks, liabilities, liquidity, and other crucial aspects. They can detect patterns and nuances often missed by the human eye.

In an era where public interest in stock and cryptocurrency investment is steadily growing, AI-powered financial planning software is providing a much-needed competitive edge. It makes investment advice more accessible and affordable, delivering it directly to people’s smartphones. However, the influence of AI extends beyond just the stock market. It’s also driving progress in other fintech areas, including insurance technology and personal budgeting.

The financial planning and analysis (F&PA) market is currently a hotbed for AI-driven technological innovation. Companies are leveraging AI solutions to uncover various business drivers, generate accurate forecasts, enhance real-time decision-making, and ultimately improve their return on investment (ROI). With AI bringing such extensive benefits to the table, one might wonder, what more could we ask for? The future of financial planning, clearly steered by AI and ML, is not just a promise but a rapidly unfolding reality, reshaping the financial landscape in ways we are only beginning to grasp.

Enhance your financial services with AI-driven solutions for advanced financial planning. Start optimizing your financial strategy today with LeewayHertz’s AI expertise!

Start a conversation by filling the form

All information will be kept confidential.

FAQs

How does AI improve financial planning?

AI enhances financial planning by automating repetitive tasks, analyzing substantial amounts of data quickly and accurately, recognizing patterns and trends, and generating actionable insights for making informed decisions.

How does AI address challenges in financial planning?

AI addresses challenges in financial planning by analyzing large datasets to identify trends, predict market movements, assess risk factors, and provide personalized recommendations tailored to individual financial goals and risk tolerance levels.

What are the key advantages of using AI in financial planning?

The benefits of AI in financial planning include improved accuracy in forecasting, personalized recommendations based on individual financial goals and risk tolerance, increased efficiency through automation, and better risk management.

How does AI help in wealth management?

AI helps in wealth management by providing insights into investment opportunities, optimizing asset allocations, rebalancing portfolios, assessing risk profiles, automating routine tasks, and offering personalized financial advice to high-net-worth individuals and institutions.

Can AI assist in tax planning and optimization?

Yes, AI can assist in tax planning and optimization by analyzing tax laws, identifying tax-saving opportunities, optimizing deductions and credits, and providing recommendations to minimize tax liabilities while staying compliant with regulatory requirements.

How does LeewayHertz help implement AI in financial planning?

LeewayHertz offers AI-driven financial planning solutions tailored to the specific needs of clients. Our expertise in artificial intelligence, machine learning, and data analytics enables us to develop custom financial planning applications that automate processes, improve decision-making, and optimize investment strategies for individuals and financial institutions alike.

What AI solutions does LeewayHertz offer for financial planning?

LeewayHertz offers a range of AI solutions for financial planning, including predictive analytics, anomaly detection, and sentiment analysis. Our AI solutions can help financial institutions gain actionable insights from large datasets, improve forecasting accuracy, and streamline decision-making processes.

Can LeewayHertz integrate AI solutions into my existing financial planning systems?

Yes, LeewayHertz can integrate AI solutions into your existing financial planning systems, enhancing their capabilities. Whether it’s implementing AI algorithms for predictive analytics, developing AI-powered chatbots for customer interaction, or deploying AI-driven risk management tools, we can customize solutions to seamlessly integrate with your current workflows and infrastructure.

How does LeewayHertz ensure data security in AI-driven financial planning solutions?

LeewayHertz prioritizes data security in AI-driven financial planning solutions through robust measures such as encryption, access controls, and adherence to data protection regulations. We implement state-of-the-art security protocols to safeguard sensitive financial data against unauthorized access, ensuring compliance with industry standards and regulatory requirements. Additionally, our team stays abreast of emerging cybersecurity threats and continuously updates security measures to mitigate risks and protect client information.

Can LeewayHertz customize AI solutions for specific financial planning needs?

Yes, LeewayHertz specializes in developing custom AI solutions tailored to the unique requirements of financial institutions. Whether it’s optimizing investment strategies, improving risk management practices, or enhancing customer engagement, our team can design and implement AI solutions that align with your organization’s goals and objectives.